Domestic bourses hits fresh new high

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Domestic bourses continued to trade in fine contour on continued buying by funds and retail investors by crossing new record peak of 53,400 (Sensex ) and 16,000 (Nifty) in the noon session. Sentiment perked up as macros were turning very positive with the declining fiscal deficit and rising tax collections. Traders also remain energized India’s exports grew by 47.19 per cent to $35.17 billion in July on account of healthy growth in the outbound shipments of petroleum, engineering, and gems and jewellery. Imports during the month also rose by 59.38 per cent to $46.40 billion, leaving a trade deficit of $11.23 billion. On the global front, Asian markets were trading mixed as jitters about the spread of the coronavirus's delta variant dented enthusiasm about strong corporate profits.

Back home, in scrip specific development Infosys joined the elite club of companies with Rs 7 trillion market capitalization (m-cap) on the BSE after its share price hit a new high of Rs 1,646.40 in the intra-day deals. Currently, BSE Sensex is currently trading at 53475.92, up by 525.29 points or 0.99% after trading in a range of 53088.35 and 53476.27. There were 26 stocks advancing against 4 stocks declining on the index.

The broader indices were trading mixed; the BSE Mid cap index lost 0.01%, while Small cap index was up by 0.34%.

The top gaining sectoral indices on the BSE were Telecom up by 1.41%, Consumer Durables up by 1.34%, FMCG up by 1.05%, TECK up by 1.04% and IT was up by 0.98%, while Metal down by 0.74% and Basic Materials was down by 0.16% were the only losing indices on BSE.

The top gainers on the Sensex were Titan Company up by 3.92%, Sun Pharma up by 3.38%, HDFC up by 2.80%, Bharti Airtel up by 2.40% and Indusind Bank was up by 2.13%. On the flip side, Tata Steel down by 0.68%, Bajaj Auto down by 0.67%, NTPC down by 0.47% and ICICI Bank was down by 0.04% were the top losers.

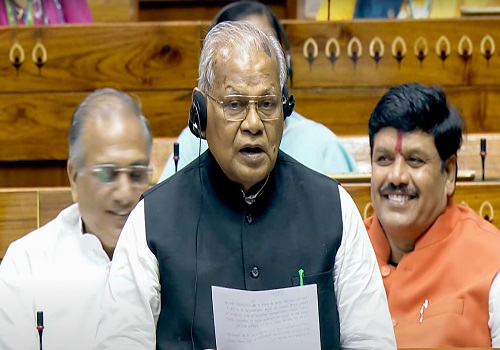

Meanwhile, Minister of State for Finance Bhagwat Karad has said that there is no proposal under consideration to waive loans of farmers, including Scheduled Caste and Scheduled Tribe farmers. He said the Centre has not implemented any farm loan waiver scheme since 'Agriculture Debt Waiver and Debt Relief Scheme (ADWDRS), 2008'.

Karad also listed major initiatives taken by the government and the Reserve Bank of India to reduce the debt burden of farmers and for welfare of the people engaged in agriculture, including those belonging to Scheduled Castes and Scheduled Tribes.

The minister cited schemes like interest subvention for short-term crop loans of up to Rs 3 lakh, RBI's decision to raise the limit for collateral-free agriculture loan from Rs 1 lakh to Rs 1.6 lakh, and direct income support of Rs 6,000 per year to farmers under Pradhan Mantri Kisan Samman Nidhi.

The CNX Nifty is currently trading at 16018.10, up by 132.95 points or 0.84% after trading in a range of 15914.35 and 16025.00. There were 37 stocks advancing against 13 stocks declining on the index.

The top gainers on Nifty were Titan Company up by 3.84%, Sun Pharma up by 3.20%, HDFC up by 2.87%, Bharti Airtel up by 2.37% and Indusind Bank was up by 2.03%. On the flip side, Grasim Industries down by 1.66%, JSW Steel down by 1.56%, Shree Cement down by 0.94%, Bajaj Auto down by 0.72% and Tata Steel was down by 0.67% were the top losers.

Asian markets were trading mixed; Shanghai Composite declined 20.89 points or 0.6% to 3,443.40, Nikkei 225 slipped 139.19 points or 0.5% to 27,641.83, Hang Seng decreased 104.45 points or 0.4% to 26,131.35 and Straits Times was down by 19.12 points or 0.6% to 3,142.10.

On the flip side, Taiwan Weighted strengthened 50.48 points or 0.29% to 17,553.76, KOSPI rose 14.10 points or 0.44% to 3,237.14 and Jakarta Composite was up by 29.08 points or 0.48% to 6,125.62.

Above views are of the author and not of the website kindly read disclaimer

Tag News

Weekly Market Analysis : Markets strengthened recovery and gained nearly 2% in the passing w...