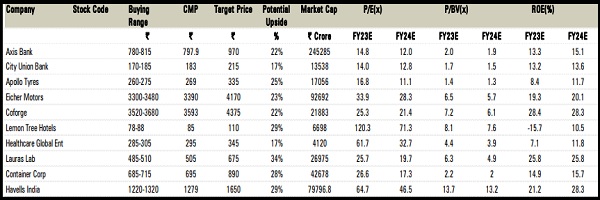

Samvat 2079 : Fundamental Diwali Muhurat Picks By ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Year 2022 has been marked by volatility on account of a wide variety of global new flows ranging from geopolitical issues, higher inflation (mainly food and energy) and hawkish action of central banks. This has led to a decline in global equities, mainly in the US and Europe. Amid all this negativity, India has relatively outperformed global peers in terms of all economic parameters (capex spend, discretionary consumption, robust pick-up in banking activity, etc). The same is reflected across Indian equity markets. Going ahead, we believe Corporate India will likely deliver earnings growth in excess of 15% over the next two years given the current economic milieu and provide a plethora of investing opportunities in Indian markets. However, sticky global inflation will keep central banks hawkish and India will be no exception. Similar implications for global liquidity flows may create medium term volatility in Indian markets. However, if such a scenario materialises, then the same will be a strong opportunity to take exposure to Indian equities. Our one year forward, Nifty target is at 19425 (21x FY24 EPS) with sectoral bias towards banks, capital goods/infrastructure, autos, avoiding sectors having more global exposure like IT, oil & gas and metals.

Given the scenario, we see reasonable opportunities across the market spectrum with key filter being quality. We continue to advise investors to utilise equities as a key asset class for long term wealth generation by investing in quality companies with strong earnings growth and visibility, stable cash flows, RoE and RoCE.

Axis Bank (AXIBAN) Buying Range (| 780-815)

• Axis Bank is one of the largest private sector banks in India with a balance sheet size of | 11.5 lakh crore as on June 2022. In terms of advances, Axis Bank has reported ~13% CAGR in the last five years and is expected to grow at a CAGR of 16.3% in FY22-24E

• The bank is focusing more on the retail segment, which has a share of ~60%, primarily mortgage loans. More than 80% of unsecured loans are given to the salaried segment. We believe pedalling business growth with higher share of unsecured loans in incremental business will continue to aid margin uptick

• The bank has cumulative provisions of 134% of GNPA, which provides comfort on asset quality and earnings volatility. In the last few quarters, asset quality has continuously been improving led by moderation in slippages as GNPA and NNPA were at 2.7% and 0.64%, respectively. Its BB and below rated book were also lowest at 0.64% as of June 2022. We believe incremental provisions will be on the lower side resulting in lower credit cost, thereby boosting earnings

• With strong capitalisation levels at ~17.8% (tier I at 15.7%), Axis Bank is poised to pedal higher business growth, going ahead • Robust business growth, improving operational efficiency and synergy benefits from the Citi acquisition would reflect positively on the earnings trajectory and price performance. We believe Axis Bank will deliver an RoA, RoE of ~1.5%, ~15%, respectively, over FY22-24E

City Union Bank (CITUNI) Buying Range (| 170-185)

• City Union Bank is an old private sector bank with primary focus on MSME and agri loans that form ~61% of overall advances. Total ~99% of its advances are secure in nature

• The bank reported ~10% CAGR in advances in the last five years and is expected to grow at a CAGR of 13% in FY22-24E. With a revival in economy, the management has also revised its credit growth guidance upwards to 15-18%, which is encouraging. Advances to top 20 borrowers constitutes ~5.3% of total advances (lower in the past few years), indicating the bank’s focus on a granular loan book

• After impact of Covid lockdowns, asset quality hiccups seem to be fading away as incremental stress formation remains under control. Led by lower slippages, GNPA and NNPA were at 4.6% and 2.8%, respectively, as of June 2022. The management has guided that recoveries and upgrades will be higher compared to fresh slippages in FY23E. However, higher slippages from the restructured book can be a spoilsport

• The bank is aiming to strengthen its digital platform and branch expansion, which will keep opex elevated in the near term. Revival in MSME is expected to benefit credit offtake as well as recoveries in stressed asset pool. Steady margins at ~4% and healthy business growth will aid operational performance and return ratios. We believe City Union Bank will deliver RoA, RoE of ~1.5%, ~13%, respectively, in FY22-24E

• With healthy CRAR at ~20.5% (tier I at 19.4%), the bank is expected to continue higher business growth in FY22-24E without any significant dilution

Apollo Tyres (APOTYR) Buying Range (| 260-275)

• Apollo Tyres (ATL) is a leading tyre manufacturer, with operations in India (~67% of sales) & Europe (~31% of sales). In India, ATL has a substantial presence in TBR (31% market share) & PCR space (21% market share). On a consolidated basis, segment wise mix is at truck, bus ~43%, PV ~35%, OHT ~10%, others ~12%. Channel mix for FY22 is as 81% for the replacement market, 19% through OEMs

• Domestically, ATL is expected to benefit from cyclical upswing in the CV space coupled with double digit growth in PV domain driven by greater consumer preference for SUVs. It has already restructured its European operations, which now on a consistent basis are reporting higher double digit margins with share of value added products on a continuous rise

• Natural rubber and crude derivatives form a majority (~65-70%) of raw material costs for tyre manufacturing. Both these commodities have witnessed a healthy correction with natural rubber down ~15% from April 2022 levels and are now hovering around the | 150-155/kg levels from the highs of | 170+/kg. Even crude is down ~20%+ from June 2022 levels and is currently hovering at ~US$90-95/barrel. This bodes well for all tyre manufacturers with ATL a key beneficiary

• With a target to achieve revenues of $5 billion by FY26, EBITDA margin of at least 15%, RoCE of 12-15% and net debt to EBITDA of less than 2x, ATL is currently focusing upon capital efficiency, sweating of assets, controlled capex spends, healthy FCF generation & deleveraging of b/s. With a reduction in debt, RoCE at ATL is seen at 13% by FY24E. It is currently trading at inexpensive valuation of ~5x EV/EBITDA on FY24E

Eicher Motors (EICMOT) Buying Range (| 3400-3450)

• Eicher Motors (EML) is market leader in the >250 cc premium motorcycle segment (market share ~85%+) through its aspirational models under the Royal Enfield (RE) brand, such as Classic, Meteor, etc. The company also has a presence in the CV space (6.6% FY22 market share) via its JV with Volvo i.e. VECV (EML has 54.4% stake). It has a strong net cash positive balance sheet with healthy return ratios metrics

• Addressing the customer need of an affordable RE product, which is easy to manoeuver, EML has recently launched Hunter 350 at an ex-showroom price of | 1.5 lakh/unit. Domestically, with Hunter 350, EML wants to tap the first time buyers and upgrades from the 100 cc+ segment and sees >125 cc segment as its addressable market with market size pegged at ~32 lakh units (RE sales in FY22 at 5.2 lakh units). Internationally, the addressable market size is pegged at ~10 lakh units (RE sales at 0.8 lakh)

• With this launch, RE reported its highest ever monthly dispatches in the recent past with September 2022 wholesales at 82,097 units, up 17.1% MoM. With continued focus on its rebalance strategy, minimal EV risk in near future, shift of consumer preference towards premium motorcycles and healthy response to Hunter 350 we expect sales volumes at RE to grow at a CAGR of 25% in FY22-24E. With operating leverage gains and decline in key raw material prices (largely metals and plastics), margins at EML are seen improving to 26.1% with consequent RoCE at ~21% by FY24E. It is currently trading at inexpensive valuations of ~28x P/E on FY24E amid high double digit growth prospects. EML also stands to gain from cyclical upswing in CV space through its JV with Volvo i.e. VECV

Coforge (NIITEC) Buying Range (| 3520-3680)

• Coforge is a global digital services and solutions provider with deep domain expertise in select industry verticals. Coforge’s differentiated value proposition is led by robust and growing capabilities in product engineering, digital solutions, data analytics, AI/ML, customer experience, business process solution, cloud, etc. The company has a presence in 21 countries with 25 delivery centres spread across nine countries and more than 22,500 technology and process experts

• Coforge has a well diversified business portfolio as BFS, insurance, travel, transportation & hospitality (TTH) and other verticals form 29.5%, 23.1%, 19.4% and 28% of revenue mix, respectively. Geography wise America forms 51% of revenue mix while EMEA & RoW form 36.9% and 11.9%, respectively

• Coforge guided for at least 20% CC revenue growth in FY23, backed by continued strong deal wins. It won 11 large deals in FY22 including a one large deal of US$ 100 mn+ deal and three US$50 mn deals. It provides visibility for near to medium term growth momentum. The revenue run rate in TTH vertical is already better than pre-Covid level and the company expects further growth in this vertical to be driven by contact less solutions across airports, cloud transformation and automation

• On the people front, it reported one of the lowest attritions in the industry. Coforge does not expect it to increase materially from here on. We bake in 19.1% revenue CAGR over FY22-24E while 220 bps margin expansion, continued offshoring focus will drive margin expansion

Lemon Tree Hotels (LEMTRE) Buying Range (| 78-88)

• Lemon Tree (LTHL) is the largest hotel chain in the mid-priced segment in India. It operates 8,497 rooms in 87 hotels across 54 destinations in India and abroad. The favourable location of its properties in prominent business and tourist districts supports revenue growth prospects and reduces concentration risk • Hotel sector outperformance in FY22 was significantly driven by Indian leisure tourists. With the opening of international borders to foreign tourists, we expect the hotel business in key cities like Mumbai and Delhi to also improve significantly. Lemon Tree is likely to be the key beneficiary of the same

• The company plans to add 738 rooms (669 rooms in Mumbai, 69 rooms in Shimla) over the next two years with total capex of | 1006 crore. Post completion of expansion, LTHL will be operating ~10,462 rooms in 105 hotels across 64 destinations, in India and abroad by FY24E

• The company is now more efficient in terms of operations and leaner in terms of cost. The current employee count has now reduced from 0.95/room to 0.62/room. Further with the adoption of more technology in day to day operations, we expect the company’s operating margin to scale up to 50% (highest in the industry) over the next one year

• The company is well positioned to capture the unorganised market share due to slowdown in the upcoming room supply in the wake of ongoing distress. We have a BUY rating on this stock with an SOTP based target price of | 110/share i.e. at 28x FY24E EV/EBITDA

Healthcare Global Enterprises (HEAGLO) Buying Range (| 285-305)

• HCG operates one of the largest private cancer care networks in India with end-to-end solutions available under a single corporate entity. Most centres are on a lease or rental basis with some in partnership with local doctors or hospitals. Owing to an exclusive agreement with vendors, HCG procures equipment on a deferred payment basis. Milann offers seven fertility centres in India • HCG network has 22 comprehensive cancer centres (one in Kenya), four multi-specialty hospitals. HCG India, capacity beds: 1944; 1702 operational. Revenue mix FY22: HCG: 96%, Milann: 4%; occupancy FY22: 58.3%; ARPOB FY22: 36,697 • HCG, with its integrated, one-stop-solution and focused model, is well poised to capture growing potential with pan-India focus on cancer therapy. Oncology cases are expected to increase by 100,000 to 350,000 cases a year, which bodes well for HCG with hybrid presence (Metros/Tier-2,3 towns) • It is focused on consolidating existing network through cost optimisation measures to improve margin and ramping up patient’s footfall by engaging in direct-to patient promotion strategies. De-leveraging of balance sheet (debt reduction from ~| 900 crore to ~| 650 crore by FY24E), reduction of losses across new centres have substantially eased legacy overhangs • We value HCG at | 345 (HCG existing centres, new centres at 12x FY24E EV/EBITDA and Milann centres at 1x FY24E EV/sales)

Laurus Labs (LAULAB) Buying Range (| 485-510)

• Laurus Labs operates in the segment of generic APIs & FDFs (formulations), custom synthesis and biotechnology. Major focus in APIs is on ARV, oncology and other APIs

• It has 11 manufacturing units (six FDA approved sites) with 74 DMFs, 32 ANDAs filed (15 Para IV, 11 first to file) and 192 patents granted

• Laurus acquired Richore Life Sciences to diversify in the area of recombinant animal origin free products, enzymes as well as building biologics CDMO

• In custom synthesis (or CRAMs) business, the company has rigorously been working for the past many years and is now well-positioned to meet fast growing global demand for NCE drug substance and drug products with ongoing supplies for seven commercial products. Formulations are expected to do well on account of product launches in anti-diabetic (FY23) & CV portfolio (FY24) in the US and Europe

• Laurus has multiple planned capacity expansions in portfolio based on complexity and scale towards strengthening and diversifying business by an increased focus on non-ARV APIs and formulations and high growth CRAMS segments

• Calibrated focus on CRAMs (half of the planned | 2000 crore capex earmarked for the same), stable API order book, increasing reactor volume, expansion of the biologic CDMO, product launches and capacity expansion are some key levers. We value Laurus at | 675 i.e. 25x FY24E EPS of | 27

Container Corp (CONCOR) Buying Range (| 685-715)

• Concor is the dominant player in the container train operator (CTO) business (~ 65% market share) with ~60 terminals. Revenue from rail transportation comprised 75% of total revenues while 4% road contributed ~ 4% with 13% revenues being generated through handling income and 2% from warehousing and 4% from other segments. Total volumes handled in FY22 were 4.1 million TeU, of which Exim volumes were at 80% of the mix with the rest contributed by domestic containers

• Over the longer term, the management expects to incur a capex in the range of | 8000-10000 crore each year for the next three to four years. The capex would be primarily utilised in developing infrastructure, purchasing containers, rolling stocks and electrical equipment

• The management has guided for clocking 6.5-7 million TeUs volumes in the next three to four years (currently at 4 million TeUs) and subsequent doubling of revenues over the period

• Newer initiatives (3PL, distribution logistics, cement and food grain transport, higher terminal utilisation, etc) are expected to diversify Concor’s offerings to customers and thereby capture higher wallet share

• Driven by higher volume growth and incremental revenues from new initiatives, we expect Concor to register a revenue, PAT CAGR of 22%, 46%, respectively, in FY22-24E. The stock is trading at reasonable valuation of 19x FY24E earnings. We expect it to be a major beneficiary of the modal shift of freight volume share from road in favour of rail as envisaged in the new National Logistics Policy

Havells India (HAVIND) Buying Range (|1220-1320)

• Over the last one decade, Havells India has transformed its business profile from being an industrial product driven business to consumer driven business. Consumer business (includes both brown and white goods) recorded strong sales CAGR of 21% in FY12-22 against overall sales CAGR of 14% during the same period. Post-acquisition of Lloyd, contribution of consumer business (includes lighting) in the topline has increased from 31% in FY12 to ~54% in FY22

• At all its business segment, Havells has a strong presence in the organised product category with market share ranging at 6-20%. The company has spent average 4-5% of its sales on the advertisement and promotional activity

• Havells is constantly working on improving its market share across its product segments through new product launches and increasing penetration in tier II and tier III cities. The company plans to spend | 700- 800 crore in FY23 to expand manufacturing capacities of air conditioner, washing machines and wire & cables

• We believe Havells will report strong revenue CAGR of 16% over FY22- 24E led by new product launches, dealer expansion. We believe softening of raw material prices and launch of premium products will result in a strong EBITDA margin recovery for the company from H2FY23 onwards (from its lowest Q1FY23 EBITDA margin of 8.5%). As result, PAT will register a strong CAGR of 20% over FY22-24E. Strong brand, robust balance sheet position & focus on improving profitability of its Lloyds business makes Havells an attractive stock in the FMEG space

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631

Above views are of the author and not of the website kindly read disclaimer

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">