Derivatives Strategy – Positional Option : Sell Bank Nifty 11 February 34500 Put By ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

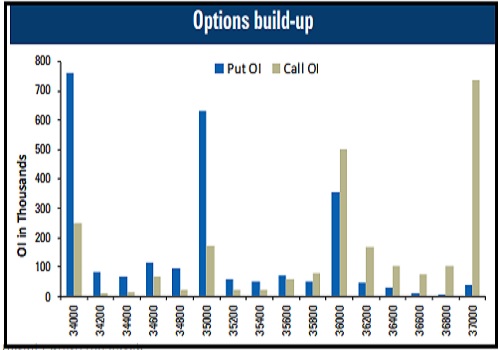

* Bank Nifty futures rallied almost 5500 points last week and managed to surpass their Call base of 36000. It started the current week above its base, which is a positive sign

* Even after the event outcome, IVs continue to remain elevated, providing added advantage to option writers. Almost 1800 points OTM Puts are trading at a premium of 110 at the start of the week, which is extremely high

* Looking at the overall F&O data we feel the Bank Nifty is likely to consolidate with positive bias. Going ahead, Put writing premiums are expected to get completely eroded

* Hence, we feel 34500 Put could be written at current levels as the Bank Nifty is likely to head towards its Call base of 37000 this week Note: 1. Recommendation initiated on iclick-2-gain on February 08, 2020 2. The given recommendation in this report is positional recommendation and should not be linked with intraday view & recommendations given on iclick-2-gain, which may have a different view on a particular day.

Positional Option: Sell Bank Nifty 11 February 34500 Put at Rs. 100-130, Target: Rs. 2, Stop loss: Rs. 240, Time frame: Till 11 February expiry

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Above views are of the author and not of the website kindly read disclaimer

Top News

Investing Guide for Young Women

Tag News

Stock Picks : TCS Ltd And Chambal Fertiliser Ltd By ICICI Direct