Currency Insight: Fed in a Tight Spot - Motilal Oswal

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Fed in a Tight Spot

Federal Reserve in its last meeting decided to raise rates and maintained its hawkish stance. Powell signalled that the Fed’s policymaking committee expected to implement 0.5% increases at its next two meetings, but was not “actively considering” a more aggressive 0.75% increase. The annual pace of consumer price inflation in the US hit 8.6% in May as energy and food costs surged. US Treasuries have jumped since the start of April and is above 3% mark ahead of the FOMC meeting scheduled this week. Most expect that Fed rates could reach upto 3% by next February. In the recent times, treasuries have been under pressure as the Fed began its long drawn process of quantitative tightening, reducing its balance sheet by allowing bonds that it bought to mature without replacing them. Be it the Fed meeting, US President’s and Treasury secretary testimony or be it the meeting between US President and fed Chairman everywhere the commentary has been that “Inflation is a concern and we need to do more to ease ongoing price rise”.

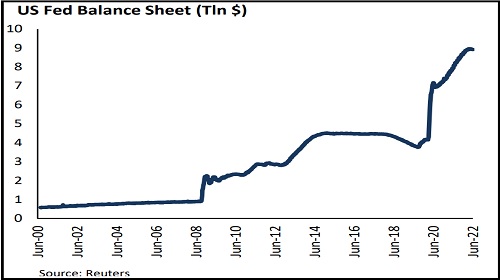

Quantitative Tightening(QT) on the go

Markets have been volatile in recent weeks as investors grappled with conflicting signs about the health of the global economy and predictions about the future paths of inflation and interest rates. Most riskier assets across the globe have been under pressure as liquidity tightening has been on the go for most central banks. With inflation resurgent and anything but transitory, as the easy money crowd has long been arguing, the Fed cannot easily back off to reassure investors, as it has for over three decades. Officials in the US are becoming increasingly concerned that shifting to neutral will not be enough. The Fed may have to slam on the brakes and also raise borrowing costs beyond 3%. Since the start of the year most investors realized that inflation was for real and yields rose across the curve.

During the last FOMC meeting, several officials also pointed to some risks to financial stability related to the tightening cycle, saying it could “interact with vulnerabilities related to the liquidity of markets for Treasury securities and to the private sector’s intermediation capacity”. In addition to monetary tightening, this month the Fed began shrinking its $9tn balance sheet, which may amount over time to the equivalent of two or three rate rises. There are two reasons why investors and policymakers are watching QT closely. The first is its potentially vast impact on monetary policy. The second being that QT will cause the treasury market to malfunction.

US Fed Balance Sheet (Tln $)

To Read Complete Report & Disclaimer Click Here

For More Motilal Oswal Securities Ltd Disclaimer http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html SEBI Registration number is INH000000412

Above views are of the author and not of the website kindly read disclaimer

Tag News

EURINR trading range for the day is 89.13 - 89.49. - Kedia Advisory

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">