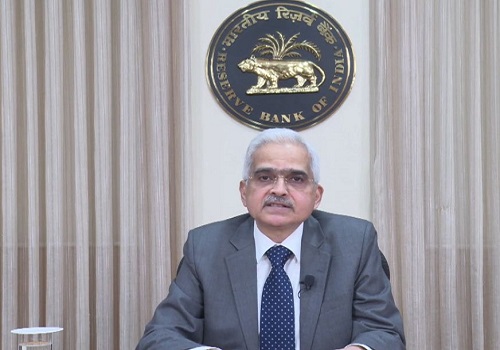

Credit ratings without lenders' info cannot be used by banks for capital computation: RBI

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

In order to improve ratings disclosures on bank credit to large customers, the Reserve Bank of India (RBI) said unless rating agencies disclose names of all lenders in their rating statements, banks cannot use such ratings for capital computation for making provisions. Reviewing the prudential norms for risk weights for exposures to large corporates and non-banking finance companies, a notification from RBI (Reserve Bank of India) said the new mandatory loan rating disclosures will be effective from March 31, 2023.

Issuing the notification and setting the new deadline, the regulator said despite repeated reminders, external credit assessment institutions have not been making the mandated disclosures citing lack of consent from borrowers. As part of the master circular on Basel III capital regulations, issued on April 1, 2022, the monetary authority had asked rating agencies to disclose the name of all the banks in the credit rating statements after getting the consent from borrowers from August 31, 2021. But they have not been doing so citing their inability to secure the consent from borrowers.

Such disclosures make banks eligible to compute their capital requirement for such loans and make the needed capital provisions. Such disclosures will make bank eligible to derive risk weights for their unrated exposures based on the ratings available for a specific rated debt, provided the bank's facility ranks pari passu or senior to the specific rated debt in all respects and the maturity of the unassessed claim is not later than the maturity of the rated claim.

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">