Copper prices to stay firm while above $9228 By Mr. Abhishek Bansal, Abans Group

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Below are Quote and Outlook on Copper By Mr. Abhishek Bansal, Founder Chairman, Abans Group.

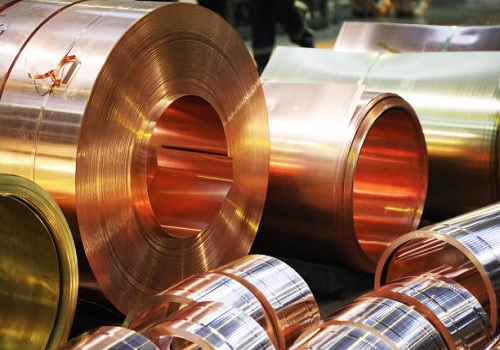

Copper prices to stay firm while above $9228

LME 3 M Copper prices are trading near $9434 which fell from the recent high of $9494.75 registered on June 30th following weak manufacturing data from China. As per the official report from the National Bureau of Statistics, China's June manufacturing Purchasing Manager's Index (PMI) eased slightly to 50.9 versus 51.0 from May however it was marginally better than the expectation of 50.80. Growth was slowed mainly because of a shortage of raw material. Additionally, the shortage of coal supply in China's southern regions, which started in mid-May, hit factory operations as well.

A stronger dollar is also keeping commodities prices under pressure. The dollar index on Wednesday rallied to a 2-1/2 month high on the backdrop of safe-haven demand from the spread of the dangerous Delta Covid variant throughout the world.

However, positive economic data from the US is likely to support industrial metals demand and copper prices. The US June ADP employment report rose +692,000 against expectations of +600,000. Also, May's pending home sales unexpectedly rose +8.0% m/m, stronger than expectations of a -1.0% m/m decline and the largest increase in 11 months. However, the Jun MNI Chicago PMI fell -9.1 to a 4-month low of 66.1, against expectations of 70.0.

Copper prices are also under pressure from a fresh rise in the Delta variant of covid cases. The overall global Covid-19 caseload has topped 182 million, while the deaths have surged to more than 3.94 million, according to Johns Hopkins University. Over the past week, 11 more countries detected their first Delta (B1617.2) variant cases, lifting the total to 96 countries.

Meanwhile, LME Copper inventory now stands at 211975mt as of July 1st, have increased nearly 91275mt in the last 30 days which is a nearly 76% change in one month. However, SHFE copper inventory has dropped by 52266mt in the last 30 days and now stands at 99334mt as of July 1st.

Copper prices are likely to stay firm while above the key support level of $9228-9135 however it is likely to face stiff resistance near 20 days EMA at $9571 and 50 days EMA at $9619.

Above views are of the author and not of the website kindly read disclaimer

.jpg)