Commodity Article :Gold continues to move Northwards, Crude prices near months high Says Prathamesh Mallya, Angel One

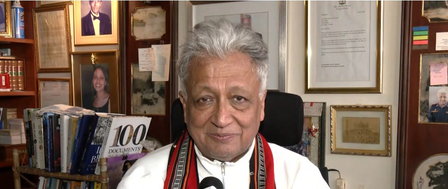

Below is Daily Commodity Article by Mr. Prathamesh Mallya, AVP- Research, Non-Agri Commodities, and Currencies, Angel One Ltd

GOLD

The yellow metal on Wednesday gained for yet another session, adding to its YTD gains. Gold was up by half a percent to 2014.7$ per ounce.

Gold prices rose as cooler-than-expected US inflation data suggested that the Federal Reserve may suspend hiking rates after a probable increase in May.

According to the minutes of the Fed's March meeting, some policymakers pondered suspending rate hikes in response to a Fed staff estimate that banking sector stress would tip the economy into recession, but judged that high inflation remained the priority.

Gold is seen as an inflation hedge, but rising interest rates make non-yielding bullion less appealing.

Outlook: We expect gold to trade higher towards 61020 levels, a break of which could prompt the price to move higher to 61340 levels.

CRUDE

Gains from the previous day were extended further, as Brent and NYMEX both ended the Wednesday's session on a higher note.

Both benchmark indices surged 2% on Wednesday, reaching their best levels in more than a month, as weakening US inflation data raised hopes that the Federal Reserve may cease raising interest rates.

However, the previous tightening, which raised interest rates to their highest level since 2007, is raising fears that the Fed's concentration on containing inflation may wind up stifling economic development and future oil demand in the world's largest oil user.

Outlook: We expect crude to trade higher towards 6960 levels, a break of which could prompt the price to move higher to 7060 levels.

BASE METALS

Post witnessing mixed sessions in the past, the base metals pack concluded the Wednesday's session on a positive note, with all the metals ending on a higher note.

Following data that showed US consumer prices climbed less than anticipated in March, which increased predictions that the Federal Reserve will likely cease raising rates after a potential increase in May, the dollar declined on Wednesday, adding to losses from the previous session.

The commodity priced in dollars became more appealing to purchase, while price rises were restrained by the forecast for global demand brought on by recessionary fears.

Additionally, the Fed's last policy meeting's minutes revealed that officials predicted that the banking sector's stress would cause the economy to enter a recession.

Outlook: Base metals are expected to remain elevated as prospects of the US Federal Reserve stopping interest rate hikes strengthened following the latest data showing inflation dropping.

Above views are of the author and not of the website kindly read disclaimer

More News

Perspective on Silver by Ms. Riya Singh - Research Analyst, Commodities and Currency, Emkay ...