Comex gold prices declined around 0.30% on Thursday due to improved initial jobless claims data from the US - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

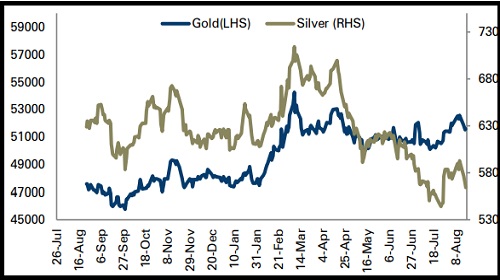

Bullion Outlook

• Comex gold prices declined around 0.30% on Thursday due to improved initial jobless claims data from the US

• The number of Americans filing new claims for unemployment benefits eased to 250,000 compared to previous levels of 252,000 for the week ended August 14, 2022

• At the same time, rising dollar index and optimistic sentiments in global markets weighed on precious metal prices

• MCX gold prices are expected to trade with a negative bias for the day amid concerns over further monetary tightening policy by the US Fed. MCX gold price is trading holding support at mean levels of | 51,540. If it moves below this, it is likely to correct towards | 51,200 for the day

• Additionally, silver prices are expected to take cues from gold prices and may move towards | 56,000 levels in coming sessions

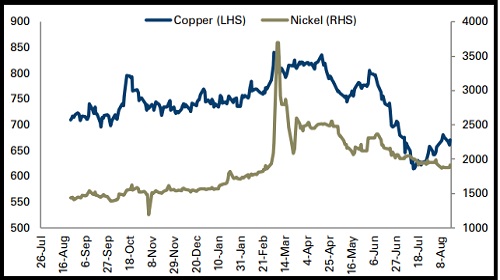

Base Metal Outlook

• LME copper prices advanced almost 1.30% as hopes of solid demand in China offset fears about the pace of interest rate rises and slowing economic growth

• Moreover, China’s Yangshan copper import premiums have risen to $102.50 a tonne, the highest since December, suggesting demand is rising

• However, elevated dollar index along with unsatisfactory housing data from the US capped further gains in copper prices

• Existing home sales in the US dropped to 4.81 million units in July 2022 compared to 5.11 million units in the previous month, lowest levels since May 2020 due to soaring mortgage rates

• MCX copper prices are expected to rally towards | 680 levels for the day amid falling LME copper inventories and hopes of further monetary policy easing from China

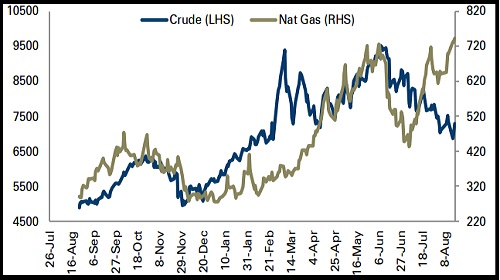

Energy Outlook

• WTI crude oil prices surged more than 2.50% on Wednesday on robust US fuel consumption data • However, possibility of increased supplies from Iran restricted further gains in oil prices

• The market is awaiting developments from talks to revive Iran's 2015 nuclear deal with world powers, which could lead to a roughly 1 million bpd boost in Iranian oil exports

• MCX natural gas prices rallied almost 1.50% on Thursday after the EIA reported that utilities added 18 billion cubic feet (bcf) of gas over the last week, which was lower than expected natural gas injection into storage

• MCX natural prices are expected to rally further towards | 665 for the day, primarily due to lower global natural gas storage levels Additionally, investors will keep an eye on rig count data from the US

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631

Above views are of the author and not of the website kindly read disclaimer

Top News

realme to give attractive offers worth Rs 700 crore this festive season in India: Madhav Sheth

Tag News

We anticipate immense potential benefits from the upcoming Sovereign Gold Bond Tranche in FY...