Buy Wonderla Holidays Ltd For Target Rs.430- ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Strong comeback post Covid era

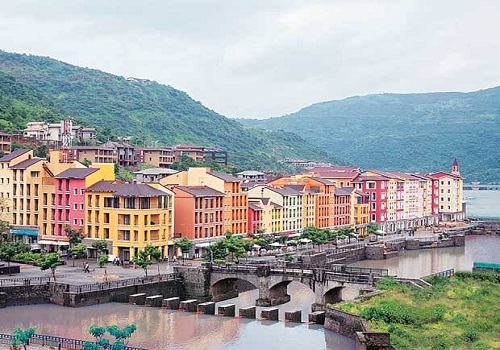

About the stock: Wonderla Holidays is engaged in the business of amusement parks and resorts. It has three operational parks, one each in Kochi, Bengaluru and Hyderabad that were established in 2000, 2005 and 2016, respectively. The Bengaluru park also has a resort with four banquet halls and 84 rooms.

*The park business is seasonal in nature with higher footfalls in June and December quarters corresponding to summer break and festive season, respectively

* The company is in discussions with the Odisha government to set up a park in Bhubaneswar on an asset-light model, where land will be taken on lease and the total cost for setting up the park will be ~| 100 crore

Company update:

* Wonderla Holidays reported strong results in Q1FY23 with revenues surpassing pre-Covid levels (i.e. Q1FY20) by 27% to | 149.4 crore. Further, controlled other expenses also helped the company to achieve EBITDA margin of 61.3%, which was 300 bps higher than the pre-Covid level

* Key drivers for growth were footfalls that were at 1.1 million (mn) (i.e. 124.4% of pre-Covid levels) while average total revenue per footfalls was up 2.1% vs. pre-Covid to | 1336. Park wise, Bengaluru park saw 7% footfall growth over pre-Covid levels while Hyderabad and Kochi parks both clocked 38-39% footfall growth over pre-Covid levels

* The company has recently signed an agreement with the Odisha government for the development of an amusement park in Bhubaneshwar for which it has signed a 90-year lease on 50.63 acres of land, which will entail total capex of | 130 crore over 24-30 months. This will be funded via internal accruals. The management estimates ticket pricing for Odisha Park to be ~60% of existing parks. Further, the company remains confident of a resolution of the local body tax issue in Chennai for the project to take off

* Incorporating a strong Q1 performance, we expect revenue and EBITDA CAGR of 74% and 203%, respectively, for FY22-24E. The company has a debt free balance sheet along with net cash/liquid investments of ~| 170 crore as of June 2022 that will take care of its expansion plans, going ahead

What should investors do: The company is likely to witness healthy traction in footfalls in FY23 after a two-year gap. With a leaner cost structure and healthy b/s, it is now in a strong position to expand its footprints in other regions

* We remain positive on the company and maintain our BUY rating

Target Price and Valuation: We value the company at | 430 i.e.21x FY24E P/E).

Alternate Stock Idea: Apart from Wonderla Holidays, we also like Easy Trip Planners.

* It is a fast growing company in the tourism space and has a strong b/s

* BUY with a target price of | 490/share

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Above views are of the author and not of the website kindly read disclaimer

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">