Buy SBI Life Insurance Ltd For Target Rs.1,580 - Yes Securities

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Sluggish sequential growth and flattish margin YoY both transient phenomena

Result Highlights

VNB margin: Calculated VNB margin for 4QFY22 rose 140bps QoQ but declined 77bps YoY to 26.9% (on effective tax rate basis)

VNB growth: VNB de-growth/growth was at -5.1%/0.9% QoQ/YoY held back by weak APE growth

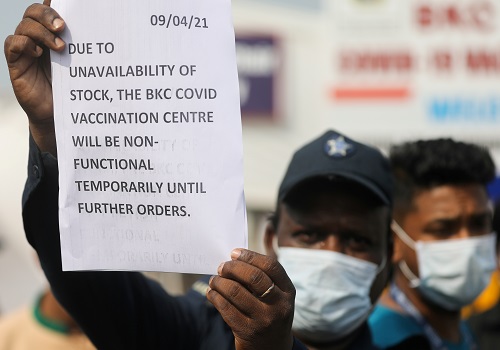

APE growth: New business APE growth was weak at -10.0%/3.8% QoQ/YoY dragged sequentially the third wave of Covid-19

Expense control: Expense ratio increased 127/104 bps QoQ/YoY to 9.0% as opex ratio increased 74/78 bps QoQ/YoY

Persistency: 37th month ratio grew/de-grew 278/-47 bps QoQ/YoY to 71% whereas 61st month ratio rose 585/354 bps QoQ/YoY to 51.1%

Our view – Sluggish sequential growth and flattish margin YoY both transient phenomena

VNB margin has inched lower on YoY basis for the quarter on account of SBIL choosing not to remain margin neutral during re-pricing: The calculated VNB margin in 4QFY22 is 26.9%, which is 77 bps lower than the calculated VNB margin in 4QFY21. The VNB margin has been flattish to lower on YoY basis despite an apparent improvement in product mix. This is because when SBI Life re-priced products in August, the re-pricing was not fully margin neutral, especially for the non-par savings product basket. Management averred that VNB margin should expand going forward due to rising share of Non-Par Guaranteed business, Deferred Annuities and Protection.

The sequential de-growth in APE was mainly on account of the third wave of Covid19, from which SBIL has already bounced back: Total APE was down 10% QoQ to Rs 41.2bn in 4QFY22. This was primarily due to the third wave of Covid-19 impacting sales in January and February. We think the third wave might have impacted SBIL more than peers since a greater proportion its, generally mass market, customers would be dependent on human mobility. Growth has recovered in March and trends are encouraging.

We maintain ‘BUY’ rating on SBIL with a revised price target of Rs 1580: We value SBIL at 3.4x FY23 P/EV for an FY23E/24E RoEV profile of 19.8/20.1%.

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://yesinvest.in/privacy_policy_disclaimers

SEBI Registration number is INZ000185632

Above views are of the author and not of the website kindly read disclaimer