Buy Copper Feb 2021 @ 608.00 SL 604.00 TGT 612.00-614.50.MCX - Kedia Advisory

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

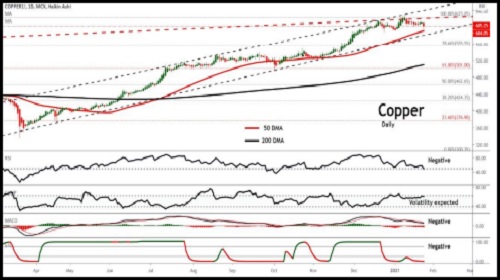

COPPER

Copper trading range for the day is 602.4-616.2.

Copper settled flat on demand worries due to rising coronavirus cases in top consumer China and ahead of seasonally slow consumption during the Lunar New Year holiday.

Copper demand growth has slowed as imports have levelled off ahead of the Chinese New Year holiday in February

China reported a climb in new COVID-19 cases driven by a spike in infections among previously symptomless patients in northeastern Jilin province

Warehouse stock for Copper at LME was at 79275mt that is down by -2850mt.

BUY COPPER FEB 2021 @ 608.00 SL 604.00 TGT 612.00-614.50.MCX

ZINC

Zinc trading range for the day is 211.8-217.6.

Zinc prices dropped on the defensive as rising COVID-19 cases and doubts over the ability of vaccine makers to supply the promised doses

Data showed that social inventories of refined zinc ingots increased 4,900 mt from last Friday

US President Biden warned citizens to prepare for the darkest days of the pandemic and announced a "wartime" pandemic prevention plan.

Warehouse stock for Zinc at LME was at 235025mt that is up by 45250mt

BUY ZINC FEB 2021 @ 214.00 SL 212.40 TGT 215.80-217.50.MCX

NICKEL

Nickel trading range for the day is 1311.8-1353.2.

Nickel prices remained supported amid the new pandemic relief bill in the US with the good news that Britain plans to deregulate.

The pessimistic news of vaccine with the new measures of pandemic prevention and blockade kept investors cautious.

According to customs data, in December 2020, China's nickel ore imports totalled 3.17 million mt, a decrease of 11.2% month on month

Warehouse stock for Nickel at LME was at 248688mt that is down by -156mt.

BUY NICKEL FEB 2021 @ 1322.00 SL 1308.00 TGT 1336.00-1344.00.MCX

ALUMINIUM

Aluminium trading range for the day is 161.7-165.3.

Aluminium gains as optimism over a $1.9 trillion U.S. stimulus plan outweighed rising COVID-19 cases and delays in vaccine supplies.

World aluminium output rose by 2.5% to a record 65.3 million tonnes last year, with producers lifting run-rates as the aluminium price rebounded from its March lows.

Global primary aluminium output rose in December to 5.67 million tonnes, up 4.22% year on year, data from IAI showed.

Warehouse stock for Aluminium at LME was at 1419775mt that is up by 6850mt.

BUY ALUMINIUM FEB 2021 @ 162.00 SL 160.50 TGT 163.50-164.40.MCX

To Read Complete Report & Disclaimer Click Here

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer