Buy Blue Star Ltd For Target Rs.1,371 - BOB Capital Markets

Strongest growth but among the cheapest valuation

* Leading player in HVAC and commercial refrigeration; also emerging as a major player in room ACs with 13% market share

* Pent-up demand post Covid, mass market AC launches, consumption of processed food and infrastructure activity to fuel growth

* Stock offers the highest EPS growth (97% FY21-FY23E) but one of the lowest valuations (39x FY23E P/E) in our coverage; initiate with BUY, TP Rs 1,371

Major player in HVAC and emerging player in RAC: BLSTR is a leading player in heating, ventilation, air conditioning (HVAC) and commercial refrigeration with 28% market share. In addition, the company has steadily expanded its share in the room AC (RAC) segment to ~13% and currently features among the top 6 players.

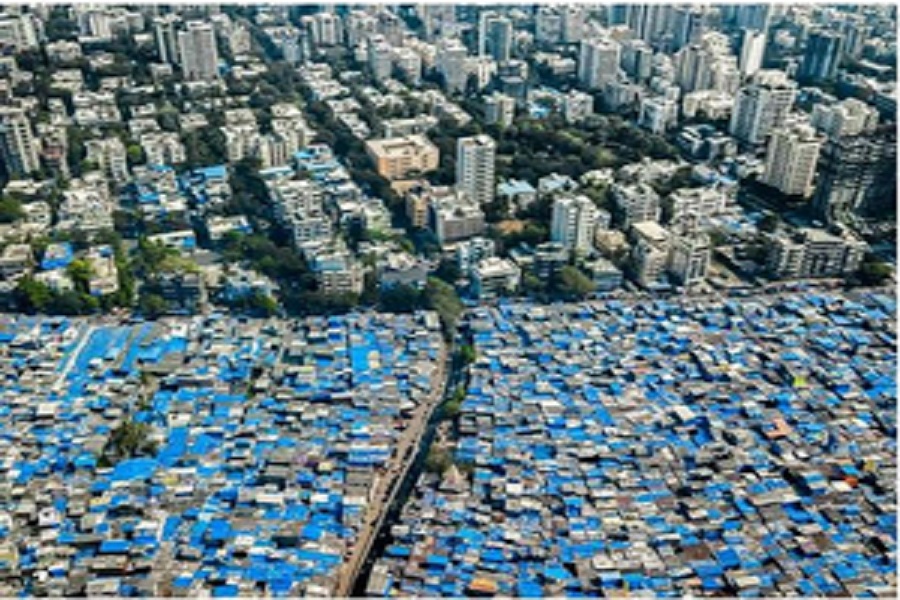

Uptrend in HVAC and refrigeration market: India’s HVAC market is expected to grow by ~10% driven by the pickup in infrastructure development (commercial buildings, metro rail, railway station modernisation). Commercial refrigeration is also gathering momentum in sectors like healthcare. Refrigeration space is becoming a must-have for retail grocery stores while the emergence of cloud kitchens and organised food delivery is further spurring demand.

Economy room AC launches to buoy growth: BLSTR has expanded market share in the RAC market to 13% from 11% in FY17 aided by launches at a lower price point. We expect the RAC category to rebound in FY22-FY23 due to two summers of pent-up demand amid the pandemic. In the water cooler business, BLSTR plans to grow via conventional distribution rather than the current online-only model, once it attains market share of +5% from ~4% at present.

FY15-FY20 EPS CAGR of 97%: We expect BLSTR to deliver a strong 97% EPS CAGR over FY21-FY23 as RAC demand recovers and the company continues to capture market share (14% by FY23E from 13% currently). We also model for highsingle-digit revenue growth in other products, viz. electromechanical projects, packaged air conditioning systems, professional electronics and industrial systems.

Initiate with BUY: BLSTR is forecast to clock the highest EPS growth in our coverage whereas its valuations are among the cheapest at 39x FY23E P/E. We initiate coverage with BUY and a DCF-based TP of Rs 1,371, which implies an FY23E P/E of 51x, 48% premium to the five-year mean. Key stock drivers include YoY recovery in Q2/Q3FY22. Keys risk include RM inflation (leading to a drop in demand), increased competition and slower growth in infrastructure projects.

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://www.bobcaps.in/disclaimer.asp

SEBI Registration No.-INZ000159332

Above views are of the author and not of the website kindly read disclaimer