IPO Updates - Brief Summary Of IPO Candidates By Axis Capital

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Issues Where SEBI Observations Received & Still Valid

1. Suryoday Small Finance Bank Ltd

Offer Details: Fresh Issue of 11,595,000 Equity Shares and Offer for Sale of upto 8,466,796 Equity Shares by Selling

Shareholders (IFC, Gaja Capital Fund II, DWM (International) Mauritius, HDFC Holdings, IDFC First Bank etc.)

Date of Filing: 01-12-2020 Date of SEBI Approval: 23-12-2020

Approx. Issue Size ( ₹ Cr): - BRLMs: Axis Capital, ICICI Securities, IIFL Securities, SBI Capital Markets

Suryoday Small Finance Bank Limited is among the leading SFBs in India in terms of net interest margins, return on assets, yields and deposit growth and had the lowest cost-to-income ratio among SFBs in India in Fiscal 2020. (Source: CRISIL Report).

They have for over a decade been serving customers in the unbanked and underbanked segments in India and promoting financial inclusion. Pursuant to receipt of the RBI Final Approval, they started operations as an SFB on January 23, 2017. Prior to commencement of operations as an SFB, they operated as an NBFC – MFI carrying out microfinance operations and operated the joint liability group-lending model for providing collateral-free, small ticket-size loans to economically active women belonging to weaker sections. Their average “priority sector” loans, as a percentage of average ANBC for Fiscal 2018, 2019 and 2020 was 99.08%, 112.10% and 103.67%, respectively. Over the years, they have diversified its loan portfolio to include nonmicro banking loans thereby reducing their dependence on micro banking business.

The Bank commenced its microfinance operations in 2009 and has since expanded their operations across 12 states and union territories, as of July 31, 2020. As of July 31, 2020, their customer base was 1.43 million and their employee base comprised 3,949 employees and they operated 482 Banking Outlets including 137 Unbanked Rural Centres (“URCs”).

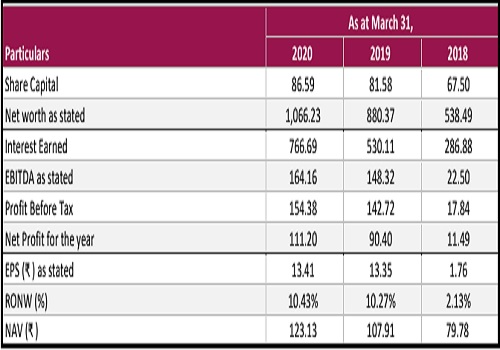

BRIEF FINANCIAL DETAILS*

2. Heranba Industries Ltd

Offer Details: Fresh Issue of Equity Shares aggregating upto ₹ 60 Cr and Offer for Sale of upto 9,015,000 Equity Shares

by Selling Shareholders

Date of Filing: 29-09-2020 Date of SEBI Approval: 27-11-2020

Approx. Issue Size ( ₹ Cr): 60^ BRLMs: Emkay Global, Batlivala & Karani Securities

Heranba Industries Limited is a crop protection chemical manufacturer, exporter and marketing company based out of Vapi, Gujarat. They manufacture Intermediates, Technicals and Formulations. They are one of the leading domestic producers of synthetic pyrethroids like cypermethrin, alphacypermethrin, deltamethrin, permitherin, lambda cyhalothrin etc. Thier Pesticides range includes insecticides, herbicides, fungicides and public health products for pest control. Their business verticals include

(a)Domestic Institutional sales of Technicals: manufacturing and selling of Technicals in bulk to domestic companies;

(b) Technicals Exports: Exports of Technicals in bulk to customers outside

India;

(c) Branded Formulations: Manufacturing and selling of Formulations under the own brands through their own distribution network in India;

(d) Formulations Exports: Export of Formulations in bulk and customer specified packaging outside India; and

(e) Public Health: Manufacturing and selling of general insect control chemicals by participating in public health tenders issued by governmental authorities and selling to pest management companies.

The company exported their products to more than 60 countries in Latin America, CIS, Middle East, Africa, Asia and South East Asia in FY 2020. As of August 31, 2020, their International Distribution Partners have successfully obtained 361 registrations of its Technicals and Formulations in 40 countries across countries in Middle East, CIS, Asia, South East Asia and Africa.

The company has more than 8,600 dealers having access to 21 depots of the company across 16 states and 1 union territory in India supporting the distribution of their products.

To Read Complete Report & Disclaimer Click Here

Above views are of the author and not of the website kindly read disclaimer

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">