Base metals maintain momentum By Yash Sawant, Angel Broking

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Below are Quote On Base metals maintain momentum By Mr. Yash Sawant, Research Associate, Angel Broking Ltd.

Base metals maintain momentum

Industrial metals have proved to be the preferred asset class by investors around the globe in these recent months.

Since April’21, most base metals have posted double figure gains on the London Metal Exchange with Copper being the stand out performer. Copper, the leader metal, touched record higher levels across exchanges on the back of a tighter supply market, increasing investments towards the green revolution and revival global economies

Global industries vouching to curb carbon emission has kept the entire industrial metals spectrum on the dais. With the world moving towards a greener environment amid the noteworthy expansion in the Electric Vehicle segment, demand for industrial metals is set to multiply in the years to come.

Many countries making the green revolution a priority due to escalating worries over climate change improved the demand outlook. Traditionally strong demand from China coupled with the world trying to adapt to a low carbon environment helped all the industrial metals continue with their momentum from 2020.

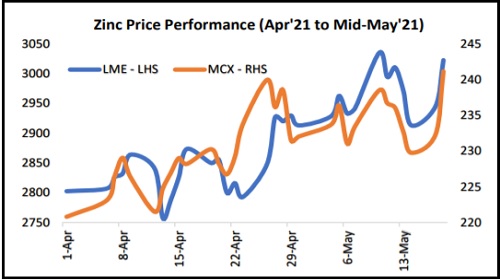

Zinc – the late boomer

Zinc Prices gained over 9 percent and 10 percent on the MCX & LME respectively in the abovementioned time frame. The galvanizing metal prices picked up in May’21 on worries of possible shortage in the global markets amid recovery in the global economies

Reports suggested that smelters stationed in China’s Yunnan province might trim their output in order to comply with energy consumption norms. Stern environmental restriction imposed by Chinese officials to contain pollution has taken a severe hit on their industrial segment. The increased scrutiny among high-energy consumption industries kept the investors cautious.

Zinc prices further strengthened as increase in taxes on mining companies in prime Zinc & Copper producing nations, Peru & Chile, might limit the output. Also, rising bets on a low interest rate environment for a prolonged period despite the recent recovery in global economies which reignited inflation worries kept a lid on the US Currency which continued to support the Dollar priced industrial metals.

TC Margins

Treatment charges for Zinc which rose to decade high levels in 2020 ($299.75 per tonne) slipped down to $159 per tonne in 2021. Major Zinc producing nations were caught in the virus wave which curtailed the mining activities forcing Global smelters trim the treatment fees following the lack of concentrate supply by global mines.

However, the gains for Zinc were capped in the earlier months as there seemed to be no evident shortage in the global refined Zinc markets despite of the fall in mine supplies. As per reports from the International Lead and Zinc Study Group (ILZSG), the global refined Zinc output increased by 1.2 percent and ended in an estimated surplus of 533,000 tonne. Even the Zinc inventories in the LME monitored warehouse rose over 40 percent in 2021 (ytd). The excessive surplus in the physical market, the hidden Zinc stocks held back the galvanizing metal prices.

Outlook

China’s move towards stabilizing the soaring Commodity prices might be a considerable headwind for the industrial metals. China vowing to strengthen its management of commodity supply and demand to restrict the "unreasonable" surge in Commodity prices might keep the global investors cautious going ahead.

Moreover, the stringent power consumption norms infused by Chinese officials might not just disrupt the supply but also affect the demand in the largest metal consuming nations.

Also, expectation of further tightening of their monetary policy by the People's Bank of China (PBOC) might weigh on the base metals prices.

We expect Zinc prices to trade lower towards Rs.215 per kg on the MCX in a months’ time. (CMP : Rs.231)

To Read Complete Report & Disclaimer Click Here

Above views are of the author and not of the website kindly read disclaimer

Tag News

On the higher side, immediate resistance is seen around 36000 - 36200 levels - Angel One

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">