Nifty futures closed at 15169 on a positive note with 54.66% - Axis Securities

HIGHLIGHTS:

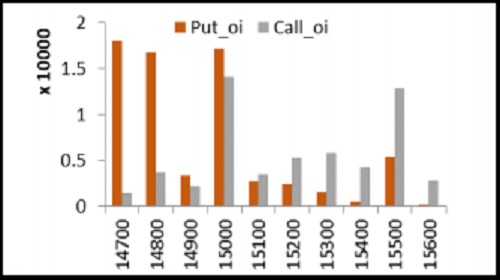

Nifty Options OI Distribution

Nifty futures closed at 15169 on a positive note with 54.66% increase in open interest indicating Long Build Up. Nifty Futures closed at a premium of 72 points compared to previous day premium of 12 points. BankNifty closed at 36720 on a positive note with 36.53% increase in open interest indicating Long Build Up. BankNifty Futures closed at a premium of 171 points compared to the previous day premium of 16 points.

FII's were Buyers in Index Futures to the tune of 382 crores and were BUYERS in Index Options to the tune of 8464 crores, Sellers in the Stock Futures to the tune of 1655 crores. Net BUYERS in derivative segment to the tune of 7947 crores.

India VIX index is at 22.89 v/s 24.17.Nifty ATM call option IV is currently 19.92 whereas Nifty ATM put option IV is quoting at 22.30

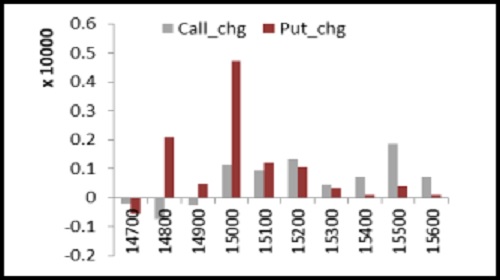

Nifty Options - Change in OI

Index options PCR is at 1.23 v/s 1.36 & F&O Total PCR is at 1.09

Among stock futures Long Build up are BHEL, RECLTD, HDFCLIFE & BEL may remain strong in coming session.

Stock which witnessed Short Build up are MARUTI, PIDILITE, DIVISLAB & MARICO may remain weak in coming session.

Nifty Put options OI distribution shows that 14500 has highest OI concentration followed by 14700 & 15000 which may act as support for current expiry

Nifty Call strike 16000 followed by 15000 witnessed significant OI concentration and may act as resistance for current expiry

To Read Complete Report & Disclaimer Click Here

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

More News

Quote on Pre-Market Comment by Hardik Matalia, Research Analyst, Choice Broking Ltd