Banking Sector Update : Strategic asset liability management and other factors to protect BoB`s margin By YES Securities

Strategic asset liability management and other factors to protect BoB’s margin

We took a closer look at the asset-liability management and other aspects of all our coverage banks and drew the following key conclusions (1) No largecap bank has positioned its deposits book for a turn in the rate cycle in the manner in which BoB has (2) The rise in share of short-term deposits for BoB has not been accompanied by a similar decline in share of retail LCR deposits (3) While share of retail deposits is healthy for BoB, it has not been garnered on the back of elevated card rates (4) In terms of asset re-pricing, there is still more to look forward to since BoB has the very highest share of non-EBLR loans in our coverage (5) BoB is quite well-placed on the loan-to-deposit ratio front as well and its ratio is one of the lowest in our coverage (6) We believe that loan mix change will be increasingly important for BoB.

No largecap bank has positioned its deposits book for a turn in the rate cycle in the manner in which BoB has

BoB is the bank with the second highest rise over FY23 in share of deposits with residual maturity less than 1 year and the highest among largecap banks. The share of deposits with residual maturity less than 1 year has risen by 768 bps for BoB over FY23. As the rate cycle turns, deposits would be available at lower cost and BoB wanted to actively position itself for the same. It is interesting to note that this strategy, in part, is underpinned by a rise in share of short-term loans for BoB. The rise in share of loans with residual maturity less than 1 year has risen by 1024 bps over FY23, the highest in our coverage universe.

The rise in share of short-term deposits for BoB has not been accompanied by a similar decline in share of retail LCR deposits

The share of retail LCR deposits has declined less than 1% point for BoB in FY23, 92 bps to be precise. This means that, from an LCR definition perspective, there has been no material decline in the share of retail deposits for BoB even though the share of shortterm deposits has risen materially. Furthermore, the period-end share of retail LCR deposits for BoB as of FY23, at 73.4%, is the healthiest among largecap banks.

While share of retail deposits is healthy for BoB, it has not been garnered on the back of elevated card rates

BoB’s SA rate of 2.75% across key SA balances is the lowest in our coverage universe, barring SBI. Similarly, the retail TD rate for the key tenure of just above 365 days is 6.75%, with only HDFCB and ICICI with slightly lower rates, among largecap banks.

In terms of asset re-pricing, there is still more to look forward to since BoB has the very highest share of non-EBLR loans in our coverage

The lion’s share of BoB’s floating rate loans is, in fact, non-EBLR, with share of non-EBLR loans being as much as ~50% of loan book, the very highest in our coverage universe. This non-EBLR book is, essentially, MCLR-linked and there is still residual upward repricing to be experienced since most of this book is based on 1-year MCLR.

BoB is quite well-placed on the loan-to-deposit ratio front as well and its ratio is one of the lowest in our coverage

BoB’s loan-to-deposit ratio as of June 2023 stood at 80.3% and is the fourth lowest in our coverage, after SBI, INBK and CUB. It may be noted that BoB’s domestic L/D ratio is lower than its overall bank ratio. Furthermore, BoB’s LCR at 140% as of March 2023 is the healthiest among largecap banks, barring SBI.

We believe that loan mix change will be increasingly important for BoB

Share of high-yield loans has risen 3.0% points over FY18-23. We believe this loan mix evolution will move the needle more meaningfully, going forward.

We most prefer BoB, AXSB, FED, SBI, INBK and ICICI in the banking space, in that order

We least prefer DCB, CUB, IDFCB and KMB in our coverage universe. Our detailed valuation table with pecking order is provided on page 29

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://yesinvest.in/privacy_policy_disclaimers

SEBI Registration number is INZ000185632

Above views are of the author and not of the website kindly read disclaimer

Tag News

AU Small Finance Bank jumps on entering into bancassurance tie-ups with Star Health and Baja...

More News

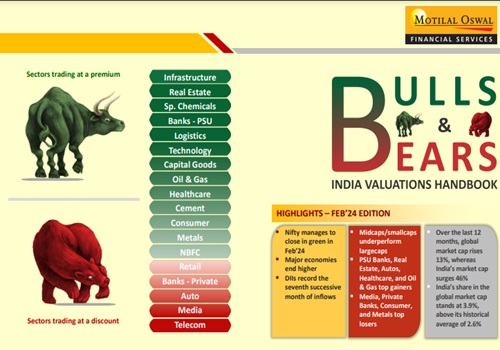

Bulls & Bears : India Valuations Handbook By Motilal Oswal Financial Services Ltd