Bank nifty index started with a gap up opening - Angel Broking

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

Sensex (51280) / Nifty (15175)

Now a days it’s very common to have a gap up opening in our market and on Wednesday too, we started with more than half a percent gains around 15200. In the first half, index cooled off a bit to fill the entire opening gap. However, post the mid-session, the buying once again resumed at lower levels to conclude the weekly expiry convincingly around the 15200 mark.

The overall undertone has been bullish; but the momentum is clearly lacking in all key indices. As far as levels are concerned, 15220 – 15275 are to be seen as immediate hurdles. If index has to gain any momentum in the upward direction, it is possible only after surpassing the above mentioned resistance zone. On the flipside, 15100 – 14925 are the levels to watch out for. With a near term view, we still remain a bit sceptical and hence, advise traders to avoid aggressive bets even if Nifty manages to breakout on the higher side. Despite indices are stuck in a range, the individual stocks are still providing better trading opportunities but going ahead, one needs to be very selective in stock picking as well.

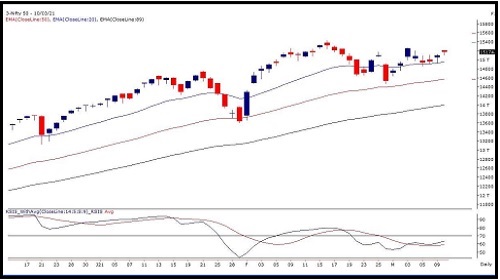

Nifty Daily Chart

Nifty Bank Outlook - (35938)

Following the positive momentum from the previous session, the bank nifty index started with a gap up opening however there was no follow-up buying, and the bank nifty remained in a range to eventually end with marginal gains of 0.20% at 35938. If we meticulously observe the daily chart, the bank index for the past one month is trading in a 'Descending Triangle' pattern and after bouncing from the lower side of this pattern the prices have now reached the higher side of this pattern. Currently, the dynamic level of this pattern is placed at 36500 and 34600 and as the trading range of this pattern is getting coiled one can expect a breakout from this pattern in the very near term. The pattern breakout can trigger the next directional move and till then traders are advised to have a stock-specific approach from this basket with a proper exit setup.

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://trade.angelbroking.com/Downloads/ARQ-Disclaimer-Note.pdf

SEBI Registration number is INH000000164

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

On the higher side, immediate resistance is seen around 36000 - 36200 levels - Angel One