Bank Nifty is likely to face resistance on higher side as 36200 and 36500 - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Daily Snapshot

* The rupee extended losses for a second straight session on Tuesday and fell by 16 paise to end at 74.42 on the back of a strong recovery in the Dollar index

* The dollar steadied in early trading on Wednesday, trading near its four month highs of 93 levels, maintaining its resilience over growing expectations that the US Federal Reserve could begin asset tapering sooner than expected

* The Nifty saw a volatile day where it managed to close with a gain of more than 0.09%. As per options data, the Nifty is likely to remain range bound as 16200 Put and 16300 Call hold significant OI

* On Tuesday, the Bank Nifty tried to sustain above 36200 but failed and closed almost fall. According to options data, the Bank Nifty is likely to face resistance on higher side as 36200 and 36500 Call option holds significant OI. On the other hand, 36000 Put holds meaningful OI, which should act as immediate support

* Foreign institutional investors (FII) turned net buyer to the tune of | 369 crore on August 9. They bought worth | 445 crore in the equity market and sold worth | 76 crore in the debt market

Rupee Outlook and Strategy

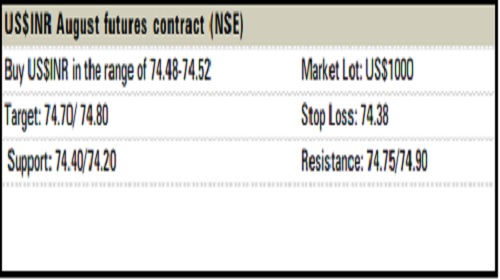

* On the options front, the US$INR has significant open interest at 74.25 and 74.50 Put strike. It suggests that US$INR is likely to consolidate above 74.50 levels. However, positive domestic equities will limit the depreciation of the rupee

* The dollar-rupee August contract on the NSE was at | 74.51 in the last session. The open interest fell almost 2% for the August series

US$INR Strategy

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

EURINR trading range for the day is 89.13 - 89.49. - Kedia Advisory

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">