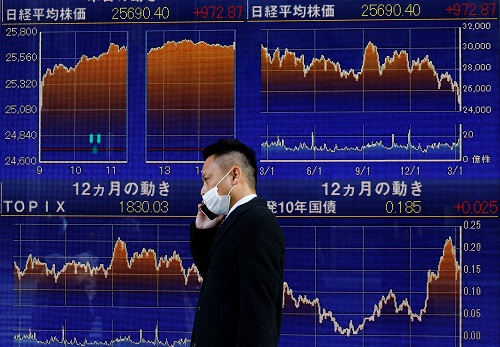

Asian shares follow Wall St advance as inflation panic eases

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

WASHINGTON - Asian stocks were set to track Wall Street gains on Tuesday as bond yields pulled back, easing concerns about inflation although investors are keeping a close eye on rising COVID-19 cases in Europe.

Hong Kong's Hang Seng index futures rose 0.5%, while Australian stocks were up 0.3%. In Japan, Nikkei futures were 0.8% higher. E-mini futures for the S&P 500 gained 0.06%.

Global equities gained and safe-haven assets rallied on Monday as investors balanced concerns over rising COVID-19 cases in Europe against a break in the recent run-up of bond yields. Shares earlier took a hit from a surprise move by Turkey's President to replace the central bank governor with a critic of high interest rates.

On Wall Street, the Dow Jones Industrial Average rose 0.32%, the S&P 500 gained 0.70% and the Nasdaq Composite added 1.23%.

Benchmark 10-year notes last rose 15/32 in price to yield 1.6787%, down from 1.732% late on Friday.

"U.S. risk assets were aided by a dip in Treasury yields to start the week. Movements in yields will continue to be closely watched this week amid a series of U.S. Treasury auctions and testimony by Treasury Secretary Yellen and Fed Chair Powell," ANZ Research said in a daily note.

Federal Reserve Chair Jerome Powell said in remarks prepared for a congressional hearing on Tuesday that the U.S. recovery had progressed "more quickly than generally expected and looks to be strengthening".

Powell and other Fed officials were expected to make more statements later this week.

Crude oil prices steadied after a sell-off, even as new European coronavirus lockdowns damped hopes of a quick recovery.

Elsewhere in commodities, aluminum prices hit their highest since June 2018 as investors worried Chinese efforts to reduce smelter pollution would curb output.

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">