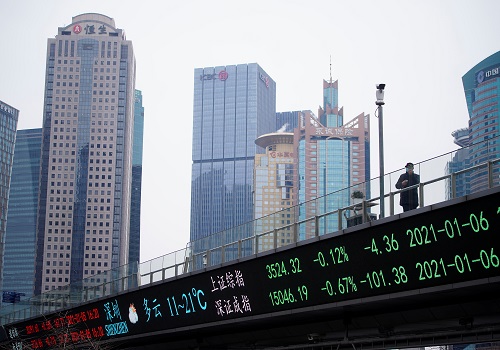

Asian shares find support as Powell shrugs off inflation

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

TOKYO- Asian shares held firm on Thursday after Federal Reserve Chair Jerome Powell said the U.S. economy was "still a ways off" from levels the central bank wanted to see before tapering its monetary support.

A raft of Chinese economic data due later in the day, will be a major focus in Asia as will earnings from major companies, including Taiwanese chipmaker TSMC.

MSCI's broadest index of Asia-Pacific shares outside Japan was little changed in early trade while Japan's Nikkei dropped 0.4%.

Wall Street shares were mixed, with S&P ending 0.12% higher and Nasdaq down 0.22%.

In testimony to the U.S. House of Representatives Financial Services Committee, Powell also said he is confident recent price hikes are associated with the country's post-pandemic reopening and will fade.

His comments came after data published this week showed consumer prices increased by the most in 13 years in June while producer prices accelerated to the largest annual increase in more than a decade.

Powell gave fresh assurance to the markets that the Fed is not too hawkish about taming inflation, said Chotaro Morita, chief rates strategist at SMBC Nikko Securities.

Bond yields dipped globally, with the 10-year U.S. Treasuries yield slipping to 1.348%, having peaked out at 1.423% on Wednesday.

The yield on inflation-protected bonds, sometimes called the real yield, dropped below minus 1.0%, staying near its lowest levels since February.

"Given declines in bond yields started before Powell's speech, the market was probably driven more by short-covering and unwinding of underweight positions than Powell's comments per se," SMBC Nikko's Morita also added.

In the currency market, Powell's dovish stance put a dent on the U.S. dollar.

The euro bounced back to $1.1835 from Wednesday's three-month low of $1.1772. The dollar stood at 109.99 yen after 0.6% fall on Wednesday.

The Canadian dollar was little changed at C$1.2518 per U.S. dollar after the Bank of Canada cut its weekly net purchases of government bonds, expressing confidence growth would rebound strongly.

Gold jumped to a one-month high of $1,829.8 per ounce on Wednesday and last stood at $1,826.1.

Oil prices eased after major global oil producers came to a compromise about supply and after U.S. data showed demand slacked off a bit in the most recent week.

U.S. crude futures dropped 1.0% to $72.40 per barrel while Brent futures lost 0.8% to $74.18 per barrel.

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">