Agri Picks Daily Technical Report 11 June 2021 - Geojit Financial

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

SPICES

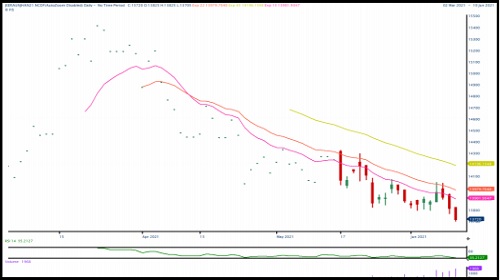

* Spices were under pressure on NCDEX on Thursday too. Dhaniya July futures declined the most, more than one per cent, followed by Jeera and Turmeric July futures. Turmeric, Jeera and Dhaniya came under pressure from subdued domestic and overseas demand as most of the markets were shut on lock down restrictions. Lower arrivals in the spot market also weighed on prices.

* Spices Board pegs Apr-Dec 2020 jeera exports 221,000 tons, up 30% on year.

* According to a survey conducted by the Federation of Indian Spice Stakeholders, jeera production in India is likely to be 478520 tons in 2020-21 (Oct-Sep), down by 11 per cent yoy.

* Government estimates 2020-21 jeera output at 887000 tons compared to 912000 tons a year ago.

* According to the second advance estimates released by the Gujarat’s farm department, production in jeera is expected to be at 373700 tonnes in 2020-21 compared to 375420 tonnes produced last year (2019-20).

* According to Spices Board, coriander exports for the April-Dec 2020 period rose by 12 per cent to 41000 on year on year basis.

* Government sees 2020-21 coriander output at 720000 tons compared to 701000 tons a year ago.

* Coriander production in Gujarat is expected to rise 55 per cent to 216680 tonnes in 2020-21 season (Jul-Jun) due to sharp rise in acreage according to the state’s farm department’s second advance estimates.

* Spices Board sees Apr-Dec 2020 turmeric exports 139,000 ton, up 34% on year.

* Government sees 2020-21 turmeric output at 1.11 million tonnes compared to 1.15 million tons a year ago.

* Spices Board pegs Apr-Dec 2020 small cardamom export 4,300 ton, up 196% on YoY basis.

* Government pegs 2020-21 cardamom output at 25000 tons compared to 21000 tons a year ago.

* Spices Board pegs Apr-Dec 2020 spices export at 1.1 million tons, up 26% on year.

* The Spices Board India has suspended e-auctions of small cardamom in Tamil Nadu's Bodinayakanur and Kerala's Puttady from Monday, it said in a circular. Further decisions will be taken as per the directions of the respective district administrations, the board said in a circular.

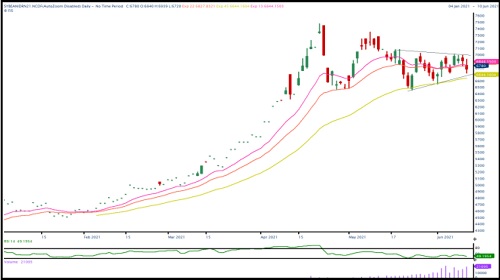

OILSEED

* All commodities in the oil seed complex extended its selloffs. July RM seed contract extended its weakness due to poor demand in the spot markets form oil millers. July Soybean futures traded lower due to weak domestic demand along with expectation of higher acreage. However, major upside moves were capped on strength in U.S CBOT soybean prices. CPO MCX June futures and Refined Soy oil June futures on NCDEX traded lower tracking weakness in global markets. Fall in BMD Malaysian palm oil prices on reports of dips in export demand and rise in output and inventory weighed on domestic edible oil prices too.

* The government has banned the blending of mustard oil with multi-source edible vegetable oils from Tuesday and prohibited its sales from Jul 1, according to a notification by the Food Safety and Standards Authority of India.

* The Central Organisation for Oil Industry and Trade has urged the government to prohibit import of edible oils from Nepal and Bangladesh at zero duty as it hurts domestic manufacturers.

* The government will distribute about 816,000 soybean seed mini-kits free of cost to farmers to ramp up oilseed output in 2021-22 (Jul-Jun) kharif season, an official release said.

* India's oilmeal exports jumped nearly three-fold on year to 303,458 tn in April, according to data released by The Solvent Extractors' Association of India.

* India's vegetable oil imports rose 32% on year to nearly 1.1 mln tn in April, The Solvent Extractors' Association of India. During Nov-Apr, the country imported nearly 6.4 mln tn of vegetable oil, up 1.7% from the year-ago period.

* India's soymeal exports rose to 80,000 tn in May from 54,000 tn a year ago, The Soybean Processors Association of India data showed. Overseas shipments of the oilmeal rose significantly due to strong demand from France and Germany, traders said. During Oct-May, exports jumped over threefold to 1.76 mln tn from 512,000 tn a year ago.

* Crushing of mustard seed by oil millers rose nearly 13% on year to 900,000 tn in May, data from Marudhar Trading Agency showed. Mills had crushed 800,000 tn of the oilseed during the same period last year. Huge demand for mustard oil in retail markets has prompted oil millers to ramp up crushing, traders said.

* India's 2020-21 (Jul-Jun) mustard output is seen rising to 22.6% on year to 8.95 mln tn, according to a joint survey by the Central Organisation for Oil Industry and Trade and the Mustard Oil Producers' Association.

* The US Department of Agriculture has scaled up its estimate for global oilseed production for 2020-21 to 598.0 mln tn from 595.8 mln tn projected in March. The upward revision is due to higher soybean, rapeseed, and peanut production. The rise is, however, limited due to smaller palm kernel, sunflower seed, and cottonseed crops, the agency said. Global soybean output is estimated at 363.2 mln tn, up by 1.4 mln tn, mainly due to higher production in Brazil. Global soybean crush is estimated 2 mln tn lower at 96 mln tn largely because of a smaller crush in China. World soybean exports are estimated 1.2 mln tn higher at 170.9 mln tn due to robust shipments from Brazil, Russia, and the US. The agency has projected world soybean ending stocks 3.1 mln tn higher at 86.9 mln tn, as purchases from China and Brazil are seen rising. The agency maintained its estimate for soybean output in the US at nearly 112.6 mln tn for 2020-21. The US Department of Agriculture has projected global oilseed output for 2021-22 (May-Apr) to rise 5.4% to 632.2 mln tn from 599.6 mln tn recorded last year. The agency attributed the 5.4% increase to robust soybean crop in Brazil and Argentina. The agency has projected world soybean output to rise by 22.6 mln tn to 385.5 mln tn. Brazil's soybean crop is estimated at a record 144 mln tn while Argentina's crop is seen 5 mln tn higher at 52 mln tn. Global output of high-oil content seeds like sunflower seed and rapeseed is projected 6% higher from 2020-21 on a recovery of sunflower seed production for Ukraine, Russia, and the EU and increased canola for Canada. Global oilseed supplies for 2021-22 are projected to rise 3% on year to 732.4 mln tn, with higher prices incentivising the expansion of oilseed area and a bigger sunflower seed crop. The agency expects soybean output in the US to come in at 119.9 mln tn for 2021-22 against 112.6 mln tn a year ago. With lower soybean supplies and higher crush, the US export share of global soybean trade is expected to decline to 33% from 36% in 2020-21. Global vegetable oil ending stocks are projected at 22.4 mln tn, down 3% from 2020-21 and the lowest in 11 years, it said.

* India is likely to produce around 10 mln tn of mustard in 2020-21 (Jul-Jun), up 35% from a year ago, due to higher acreage and favourable weather conditions, according to the Solvent Extractors' Association of India.

* Farmers in the country have sown mustard across 6.9 mln ha, up 10.6% on year, in 2020-21 (Jul-Jun) season so far, data from the farm ministry.

* Indian government slashed import duty of crude palm oil. The government cut import duty on crude palm oil by 10% to 27.5%, in the last week, to cool off soaring edible oil prices in domestic markets.

* India is likely to grow a record 10 mln tn mustard crop in 2020-21 (Jul-Jun), mainly due to the likelihood of a sharp rise in acreage, according to Solvent Extractors' Association of India. The government has targeted an alltime high crop of 12.5 mln tn for this rabi season. The government has fixed the minimum support price at 4,650 rupees per 100 kg for 2020-21 (Apr-Mar) marketing season against 4,425 rupees per 100 kg the previous year.

* According to the first advance estimates for 2020-21 (Jul-Jun), castor seed output is seen at 1.7 mln tn compared with 1.8 mln tn in the fourth advance estimates for 2019-20, according to the data released by the farm ministry. While, according to traders, crop is seen at 1.5-1.6 mln tn. Farmers have sown castor seed across 792,000 ha in 2020-21 (Jul-Jun), down 16% from a year ago.

* India's exports of castor oil rose 18.7% on year to nearly 650,000 tn in 2020-21 (Apr-Mar), said B.V. Mehta, executive president, The Solvent Extractors' Association of India. Exports were at 547,646 tn in 2019-20.

* Malaysia's crude palm oil output rose 2.8% on month to nearly 1.6 mln tn in May, data from the Malaysian Palm Oil Board. Total palm oil stocks in the country increased 1.5% on month to around 1.6 mln tn. The export of palm oil in May fell 6% on month to nearly 1.3 mln tn. On the other hand, the export of biodiesel plunged 47.8% on month to just 14,643 tn.

* Malaysia's palm-oil exports in May are estimated to have risen 1.6% on month to 1.4 mln tn, as per cargo surveyor AmSpec Agri Malaysia data.

Cotton

* The US Department of Agriculture has pegged global production of cotton in 2021-22 (Aug-Jul) at 119.4 mln bales (1 US bale = 218 kg), compared with its estimate of 113.1 mln bales for 2020-21. The projected output in 2021-22 is higher due to projections of bigger crops in Brazil, Australia, Mali, Pakistan, India, and Turkey, the agency said in its World Agricultural Supply and Demand Estimates report. Global cotton consumption is seen at 121.5 mln bales in 2021-22, the highest in four years, as global income growth remains strong. For 2020-21, global consumption is estimated at 117.4 mln bales. Cotton exports are pegged at 45.5 mln bales, compared with 46.2 mln bales estimated in 2020-21. Global ending stocks in 2021-22 were pegged at 90.9 mln bales, against 93.2 mln bales in 2020-21. The output in India is expected to rise marginally to 29.0 mln bales in 2021-22 from its estimate of 28.5 mln bales for the ongoing year. India is the top producer of cotton. In the US, production is likely to rise to 17 mln bales in 2021-22, compared with the estimate of 14.6 mln bales in 2020-21. US producers intend to plant cotton over 12.04 mln acres in 2021-22, down 0.4% from the previous year. The US is among the major producers of cotton.

* The Cotton Association of India has scaled up its estimate for ending stocks for 2020-21 (Oct-Sep) to 11.6 mln bales (1 bale = 17 kg) from 10.6 mln bales projected a month ago. The rise is mainly attributed to a decline in domestic demand. Domestic consumption is projected at 31.5 mln bales, against 33.0 mln bales estimated the previous month. The association has also raised its estimate for exports to 6.5 mln bales from 6.0 mln bales a month ago. In the current marketing year, India shipped around 5.0 mln bales till April. It has maintained its production and import estimates for the year at 36.0 mln bales and 1.1 mln bales, respectively. Production in the northern region, which includes Punjab, Haryana and Rajasthan, is seen at 6.6 mln bales. In the central zone, which includes Gujarat, Maharashtra and Madhya Pradesh, the output is estimated at 19.5 mln bales. In the southern region, production is pegged at 9.5 mln bales. Of the total crop, around 33.6 mln bales had arrived in markets across India till April .

* The US Department of Agriculture's Foreign Agricultural Service has pegged cotton output in India in 2021- 22 (Aug-Jul) at 29.5 mln bales (1 US bale = 218 kg), up 4% on year, the agency said in its April report. Yields are expected to improve by 5% based on the expectation of a normal monsoon forecast by India Meteorological Department. The area under cotton is seen at 12.9 mln ha in 2021-22, compared with an estimated 13.0 mln ha the previous year. The average yield of cotton is expected to rise to 498 kg per ha from 474 kg last year. India's cotton consumption in 2021-22 is projected at 25.3 mln bales, nearly 8% higher on year, as mill consumption is expected to increase. The agency has raised its export estimate to 6.0 mln bales, up 15% on year. As Indian cotton prices are expected to remain at a discount due to a large crop, the price advantage could lead to higher exports than last year as demand recovers across major buying markets. Top cotton export destinations were Bangladesh, China, Vietnam, and Indonesia. Imports for India in the 2021-22 crop year are pegged at 1.0 mln bales. The closing stock of cotton for the country has been pegged at 16.5 mln bales, 5% higher on year.

* The International Cotton Advisory Committee, in its May report, has scaled up its global ending stocks estimate for 2020-21 (Aug-Jul) to 22.1 mln tn from 20.9 mln tn projected in April. The revised estimate for ending stock is mainly due to bigger crop in India and China. India will lead global production at an estimated 6.3 mln tn for 2020-21. China is expected to be the second largest producer with 5.9 mln tn. Global production for the ongoing season is estimated at 24.6 mln tn, against 24.1 mln tn projected a month ago. The committee has marginally raised its global consumption to 24.97 mln tn from 24.54 mln tn a month ago due to rise in demand from China, India and Turkey. Global exports are seen higher at 9.8 ln tn, compared with 9.5 mln tn a month ago. The committee has revised upwards its price forecast for Cotlook A index, a global benchmark for prices of raw cotton, by 1% from the previous month to 80 cents per pound.

* The UK-based Cotton Outlook has scaled up its estimate for global output in 2020-21 (Aug-Jul) by 145,000 tn to 24.2 mln tn. The estimate in the April report has been revised upward largely because production in China, Brazil and Australia is expected to be higher. For the current season, the agency has maintained its crop estimate for at 6.1 mln tn. Production in the US is seen at 3.2 mln tn. Global cotton consumption in 2020-21 is seen at 24.8 mln tn, against 24.9 mln tn projected the previous month. Consumption is seen marginally lower due to a fall in demand from Indonesia. Ending stocks of the fibre for 2020-21 are seen at 624,000 tn, against 814,000 tn projected last month.

* India's cotton exports are likely to be 20% higher at 1.02 mln tn in 2020-21 (Oct-Sep) backed by its competitive pricing in the global markets and an improvement in international cotton consumption, ratings agency CARE Ratings said. Higher exports along with a recovery in domestic cotton demand will help reduce the surplus availability of cotton in the country despite higher supply, the rating agency said in a report.

* The government of Mali will provide more funding to cotton farmers to increase the crop and boost exports. The country's government will provide 8,000 cotton farmers with 20 billion CFA francs ($37 million) in total to reverse the country's poor cotton harvests in 2020-2021 season, and hit the new target set for the 2021-2022 season, the West African nation's Minister of Economy and Finance Alousseni Sanou said.

* Production of cotton in Haryana is expected to decline by 27% to 1.8 mln bales (1 bale = 170 kg) in the 2020-21 (Jul-Jun) season due to yield loss caused by Parawilt, a senior state government official told Informist. Parawilt is a disease affecting cotton plants, which causes sudden drooping of leaves when irrigation is provided after a long dry spell.

* In the Union Budget for 2021-22 (Apr-Mar), Finance Minister Nirmala Sitharaman proposed customs duty of 5% on cotton and 10% on cotton waste. She also proposed an Agriculture Infrastructure and Development Cess of 5% on cotton, taking the overall customs duty to 10%. Customs duty on raw silk and silk yarn or yarn spun from silk waste has been increased to 15% from 10% earlier.

* The area under major kharif crops so far in 2020-21 (Jul-Jun) was at 111.7 mln ha, up nearly 5% from a year ago, farm ministry data showed. Farmers have sown cotton across 13.04 mln ha in the 2020-21 (JulJun) season, up by 2.1% from a year ago, as of 25th Sept., farm ministry.

* India's cotton output in the 2020-21 (Oct-Sep) marketing year is seen at 38.0 mln bales (1 bale = 170 kg), up 4% on year, according to traders' pegs 2020-21 cotton crop at 37.1 mln bales vs 35.5 mln bales.

* Govt cuts 2019-20 cotton output view to 35.5 mln bales vs 36.0 mln. The government has raised the support price of medium staple cotton by 260 rupees per 100 kg to 5,515 rupees, and that of long staple by 275 rupees to 5,825 rupees.

OTHERS

* Chana July futures on NCDEX extended its losses in Thursday tracking weakness in the spot markets on subdued demand from the stockiest.

* Govt. pegs 2020-21 chana output to be at 12.6 million tonnes compared to 11.1million tonnes a year ago.

* Govt. aims to increase chana procurement by nearly 55 per cent to 3.25 million tonnes in the marketing year 2021-22 beginning April, under the price support scheme.

* The government has approved procurement of 14350 tons of chana Bihar during 2021- 22 rabi marketing season.

* The farm ministry has approved the procurement of 61000 tonnes of chana from Maharashtra in 2021-21 under the price support scheme according to the NAFED.

* The farm ministry has approved the procurement of 51325 tonnes of chana from Telangana in 2021-21 under the price support scheme according to the NAFED.

* India’s guar gum exports improved in the month of March 2021 by over 12% to 20,127 tonnes compared to 17,915 tonnes during February 2021 at an average FoB of US $ 1659 per tonne in the month of March compared to US $ 1993 per tonne in the month of February 2021. Further, the gum shipments were up 46% in March 2021 compared to the same period last year. Of the total exported quantity, around 6,235 tonnes is bought US, Germany (3,075 tonnes) and China (2,688 tonnes).

* India’s guar split exports rose in the month of March 2021 by 12.5% to 3,334 tonnes compared to 2,964 tonnes during February 2021 at an average FoB of US $ 1,025 per tonne in the month of February compared to US $ 1,013 per tonne in the month of February 2021. However, the guar split shipments were up 8% in March 2021 compared to the same period last year. Of the total exported quantity, around 2,521 tonnes is bought China, US (680 tonnes) and Netherlands and Switzerland (60 tonnes each).

* Rubber June futures on MCX traded steady on Wednesday.

* Kerala state government extended lockdown till June 9.

* The International Rubber Study Group (IRSG) expects global natural rubber consumption to increase by 7% in 2021, after declining 8.1% in 2020 because of the pandemic, secretary general Salvatore Pinizzotto said.

* Global natural rubber production in April declined to 903000 tonnes from 910,000 ton March, the Association of Natural Rubber Producing Countries said. Demand for the commodity was seen at 1.12 million tonnes compared to 1.23 million tonnes a month ago .

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at www.geojit.com

SEBI Registration number is INH200000345

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

We anticipate immense potential benefits from the upcoming Sovereign Gold Bond Tranche in FY...