Add Thermax Ltd For Target Rs.2,146 - ICICI Securities

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Healthy execution; margin pressure continues

Thermax has delivered strong execution with ~57% YoY revenue growth to Rs16.5bn in Q1FY23 led by 62% and 61% YoY growth in environment and energy segments, respectively. Chemical segment performance was impacted by high input and freight costs. However, high revenue growth supported EBITDA/APAT growth of 52%/40% YoY, respectively. Order intake grew 37% YoY to Rs23bn. Current orderbook stands at a robust Rs95.5bn (1.4x TTM sales). Overall order pipeline continues to remain strong with expected revival in both international and domestic capex, which augers well for the company. We remain positive on the company led by its strong order backlog and leadership in the fast growing energy-efficient technology. We upgrade our rating on the stock to ADD from HOLD with a revised SoTP-based target price of Rs2,146 (previously: Rs2,098).

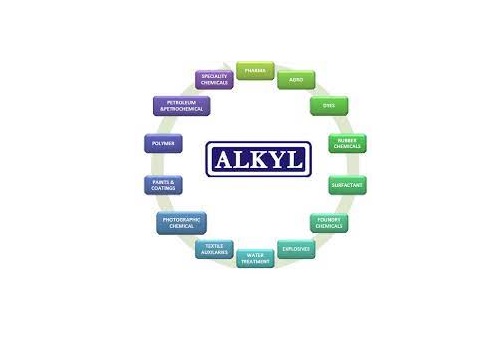

* Healthy momentum in execution sustains: Robust execution and price hike led environment and energy segments’ revenues to grow 62% YoY and 61% YoY to Rs2.9bn and Rs12.2bn, respectively. Chemical segment revenue growth was limited to 22% YoY at Rs1.5bn due to restricted availability of styrene and exposure to Russia.

* Higher commodity and freight costs impacted margins: During the quarter, although energy segment posted stable margins, environment and chemical segments bore the brunt of high commodity prices. EBIT margin for energy/environment segment expanded 240bps/20bps to 6.1% and 1.7%, respectively. Chemical’s EBIT margin contraction of 1,400bps was largely due to higher raw material, gas and freight costs. Company is in the process of passing on the increase in RM costs; expects improvement in margins from Q2FY23E. Further, recent correction in majority commodity prices is expected to support margin expansion for FGD orders in environment segment as well.

* Strengthening of orderbook continues: Order intake for the quarter was strong with 37% YoY increase to Rs23bn, led by a Rs5.2bn order for utility boilers for a petrochemical complex in Rajasthan. Energy / environment / chemical segment order inflow grew 41% / 35% /6% YoY to Rs17.6bn / Rs4bn / Rs1.5bn, respectively. Enquiry pipeline continues to remain robust especially from refining, petrochemical industry and for mid-sized orders for company’s green offerings. Enquiries from steel and cement continue to remain strong as well; however, management believes capex from these industries could be delayed.

* Upgrade to ADD on sustained execution: Management guided order finalisation has picked up pace with revival across multiple segments and gradual easing of domestic supply chain. Execution is likely to continue to pick up pace on the back of robust order backlog. However, as cost inflation remains a key monitorable. We believe that margins for all segments have bottomed based on the recent correction in commodity prices and as execution of new orders have commenced.

Outlook and valuation

On the back of robust order intake and strong execution over the recent quarters, we increase our execution estimates. We, therefore, raise our estimates for FY23E and FY24E earnings by 2% each. We value the company on SoTP methodology given varied growth, margin and return trajectory of the three business segments. Based on the company’s strong core competency in the energy segment and solutions around waste heat recovery, we assign 50x to FY24E earnings of the energy business. Given the healthy order prospects in FGD and leadership in the company’s energy-efficiency offering, we assign 40x to FY24E earnings of environment business. And given the strong growth prospects, and looming near-term margin pressure, we assign 25x FY24E core earnings to chemical segment. We upgrade our rating on the stock to ADD from HOLD and revise the target price to Rs2,146 (previously: Rs2,098). Key risks to our estimates: Elevated freight costs and low utilisation level in chemical segment.

To Read Complete Report & Disclaimer Click Here

For More ICICI Securities Disclaimer https://www.icicisecurities.com/AboutUs.aspx?About=7 SEBI Registration Number INZ000183631

Above views are of the author and not of the website kindly read disclaimer

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">

.jpg)