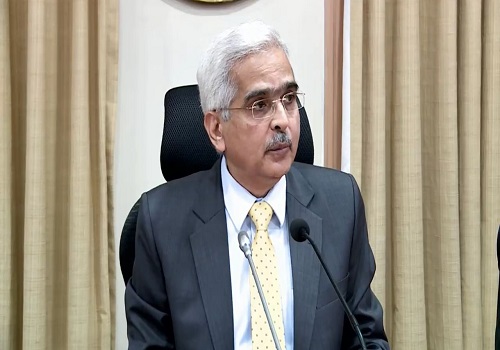

A Firm Hand - RBI Policy December 2022

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

The RBI/MPC raised repo rate by 35 bps to 6.25 per cent, as was widely expected. There was one dissent on this; from Professor Varma who preferred no hike. The stance was continued as "withdrawal of accommodation" with two dissents; from Dr. Goyal and Professor Varma. The assessment was somewhat more hawkish than general market expectation.

We elaborate upon our impressions below:

On Rate Hikes

A general sense of RBI commentary for most of the year has been that India's forecasted inflation trajectory was actually quite benign, and that growth had required extra-ordinary loose monetary conditions till the start of this year. Then the war broke and 'upset the applecart' so to speak. But by now significant parts of the war-led commodity shock, most notably in crude oil and metals, have unwound.

However, the Governor's commentary was focussed on the persistence of core inflation and the need to break this. Indeed the MPC notes the need to "keep inflation expectations anchored, break the core inflation persistence and contain second-round effects, so as to strengthen medium-term growth prospects". More generally, the potential salutary effects on output prices from correction in industrial input prices and supply chain pressures are noted. So is the recent start of correction in local vegetable prices. But on the other side there are concerns on prices of cereals and spices as well as the effect of higher feed costs into milk. There are risks from imported inflation as well.

Most pertinently, however, risks are highlighted from impending pass through of input costs that could keep core inflation firm. In particular, the Governor in his statement explicitly noted that "the resurgence in domestic services sector activity could also lead to price increases, especially as firms pass on input costs". Thus the nature of inflation risks has in some sense moved from external factors (commodity prices) to internal ones (strength of domestic activity) for the most part. This to us is the most hawkish aspect of today's policy announcement.

That said, what is also true is that these are concurrent assessments. The fact remains that while India and the west are doing better than earlier expected, global PMIs in aggregate are now in contraction zone. Both the shape of the US yield curve as well as very weak commodity price action are further highlighting the ongoing slowdown in the world.

One only need look at data coming from China as well as some of the export-oriented Asian economies if one needs further reminding of this fact. Thus, and in line with our earlier expressed views, while concurrent assessment may continue to be robust for India (even this isn't as uniformly robust as one may like), and while our innate strength from strong balance sheets is well recognised, the future may bring its own set of challenges. Also, in keeping with what seems the norm globally as we approach peak cycle policy rates, the MPC has referred to the need to watch for monetary policy measures already undertaken.

We retain our earlier expressed view of terminal repo being 6.25 - 6.50 per cent. In today's context this means that although we recognise that there aren't any explicit signals yet that this may be the end of the cycle, we aren't sure yet that another hike will be forthcoming in the February policy. Just as is the case in most places around the world, most of the tightening is done (or already expected as in the case of US and Europe) and further changes to expectation (or actual further hike in case of India) is now completely dependent on incoming data.

To be specific, in our view, there are no longer any 'pre-programmed' biases for further rate hikes in the majority of MPC members. Apart from the ongoing world developments presented above to support this argument, we note two further points: One, 'further calibrated action' being warranted referred to the need prior to this 35 bps action and doesn't constitute guidance on further rate hikes in the future. Second, given ongoing liquidity withdrawal on the back of RBI balance sheet shrinkage, progressive tightening in the system will continue via the banking channel even without RBI raising rates further. We turn to this next.

On Liquidity

The other hawkish aspect of the policy today, but one that seemed somewhat consistent with hints provided before, in our view is this: even as the assurance to inject liquidity as needed continues, the bar to do this has been kept quite high, and the Governor was explicit about this. His statement notes that RBI "will look for a durable sign of a turn in the liquidity cycle when banks draw down large part of their standing deposit facility (SDF) and variable rate reverse repo (VRRR) balances" when it decides to conduct LAF operations that inject liquidity.

He also warns that "market participants must wean themselves away from the overhang of liquidity surpluses". This has some important implications: One, the intra-month volatility in overnight rates on the back of ebb and flow of government cash balances will continue without RBI responding with 'tweak' operations. Two, and related to this, the central bank seems to be implicitly moving away from weighted average call rate (WACR) targeting (at least on a hands on basis) back towards some sort of a quantum of liquidity in the system framework.

This also means that the squeeze on deposits for banks will continue for a while. As is well known, banks don't create liquidity by hiking deposit rates. Instead, they only attract resources from elsewhere in the system (unless the rates manage to slow/reverse currency in circulation expansion as well which is unlikely). However, this is precisely what RBI may want: for banks to enhance transmission to loan rates for which deposit rates will have to increase further. This in turn will help amplify policy tightening and curtail aggregate demand.

Indeed, the Governor refers to RBI keeping "a close watch on this process of transmission". This also supports the point we made above; the current set up will ensure that tightening keeps progressing through the system even without further hikes in the repo rate. The other aspect of the same point, and one we have highlighted before, is that when markets assess the cumulative tightening done so far, attention has to be paid to RBI's balance sheet drawdown as well.

Takeaways

An important aspect of global monetary policy currently is the allowance most central banks are giving on time taken to return to inflation targets. This may be partly owing to lack of choice. Nevertheless, the focus is more on pace of disinflation rather than speedy re-attainment of inflation targets. Acting otherwise would actively court much higher output sacrifices and may even endanger financial stability. However, while this may drive 'how much to tighten' the decision on 'how long to persist' at peak levels before easing policy may very well depend upon clear visibility of targets being met. In our view, India's case is no different. Stabler inflation momentum and conclusive signs of softening (put another way, progression in line with forecasted trajectory) will cement cycle peak even as RBI may take longer to explicitly ease till it's surer that 4 per cent is attainable towards 2024.

This brings us to the micro aspects of the bond market. With a 6.25 - 6.50 per cent peak policy rate, we continue to find the most value in 3 - 5 year maturity government bonds. We aren't as convinced for longer duration (10 - 15 year maturities) for a variety of reasons. But first, we must acknowledge that we (alongside most of the market) have underestimated the resilience of longer duration this year on the back of much higher insurance sector demand and persistent notable undershoots in SDL issuances.

However, in our view, most of this effect is now captured in the relatively flat spread between longer duration government bonds versus 3 - 5 year maturities. Apart from medium term central government fiscal dynamics and the very large annual bond maturities that we have referred to before, there are near term factors to consider as well, in our view.

First, SDL undershoots have been very significant year to date (almost of the same order as the total undershoot last year) and it is possible that from here on there is better adherence to issuance calendar. Two, long tenor corporate bond supply has picked up including hybrid issuances from banks. Three, banks have been aggressive sellers of government bonds over the past month or so; presumably guided both by better valuation as well as the need to draw down their 'excess' investment books somewhat, in light of the sharp spike in incremental credit to deposit ratio (however, this doesn't solve the system level problem as noted above).

It must be noted that the extension given on the current higher held to maturity (HTM) limits for banks is not expected to have any material positive impact on incremental demand for duration but will rather help manage the unwind back to a lower 19.5 per cent limit better. Finally, and as noted above, while we are at or close to peak policy rates, there is no visibility yet on when and how many rate cuts down the line. In the meanwhile, and in light of dynamics mentioned here, a 100 bps or lesser term spread on 10 year versus overnight rate doesn't seem particularly exciting.

A final point needs mention to 'defend' our overweight 3 - 5 year government bond stance. The argument goes why 3 - 5 year government bonds when 1 year bank CDs are at 7.60 per cent. This was made even when the two rates were the same, and continues now when CD rates are almost 40 - 50 bps higher. We summarise here the same counter-argument we have been making: The relative valuation of government bonds is basis other points on the government bond curve. Here 3 - 5 year government bonds remain approximately 20 - 35 bps higher than 1 year treasury bills. This is quite comfortable given that we are towards the top of the rate cycle. CD rates will importantly respond to evolving incremental credit to deposit ratios as well, and not just to overnight rates.

This ratio is currently under pressure which is telling on bank CD rates. Thus the driver here is different and not directly comparable to the dynamics of the sovereign curve. Also, one is buying 3 - 5 year government bonds with a longer investment horizon in mind which may also consider re-investment risks beyond the 1 year horizon that bank CDs cannot plug.

The above said, and as a standalone investment strategy meant for shorter horizons (6- 12 months), we find money market rates generally approaching levels that are quite reasonable. However, bulk of their performance drivers may have to wait for the lean credit season starting April.

The incremental credit to deposit ratio issue should have smoothened by then, both on account of seasonality (busy season to lean season) as well as owing to continued economic slowdown. But investors may have to start thinking about this in their allocation decisions from now over the next few months.

.jpg)