67% of USD 100 Bn Lent to Indian Real Estate is Stress-free By Shobhit Agarwal, ANAROCK Capital

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Below are view on 67% of USD 100 Bn Lent to Indian Real Estate is Stress-free By Shobhit Agarwal, MD & CEO - ANAROCK Capital

* Another 15% is under pressure but has scope for resolution & certainty on principal recovery

* Merely USD 18 bn worth loans under ‘severe’ stress that need immediate measures

* NBFCs & HFCs (including trusteeships) together account for 63% of total loans while banks account for 37%

* At least 75% of total lending to Grade A developers is safe; large portion of lending to Grade B & C developers needs monitoring

* cIn terms of cities, Pune & NCR are high on stress with 40% & 39% of the lending respectively, followed by MMR with 37%, Bangalore with 15% of total lending, has 76% book with no stress

* Back in 2019-end, total realty loan equalled $93 bn of which 62% was completely stress-free

* Severely stressed loan amount ($18 bn) in Indian real estate low compared to other sectors like telecom & steel, where default by one company alone equals sizable portion of stress in entire real estate

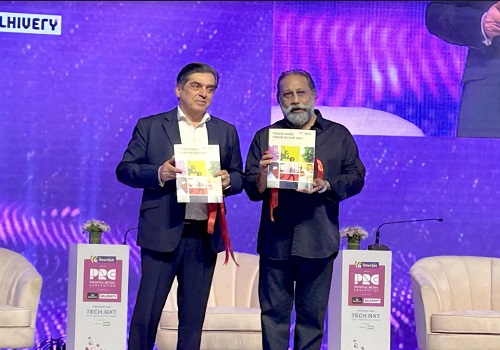

Mumbai, 26 July 2021: At least 67% (or approx. USD 67 bn) of the total loan advances (USD 100 bn) to Indian real estate by banks, NBFCs and HFCs is currently completely stress-free, reveals the latest study by ANAROCK Capital. Another 15% (approx. USD 15 bn) is under some pressure but has scope for resolution with certainty on at least the principal amount.

USD 18 bn (or 18%) of the overall lending to Indian real estate is under ‘severe’ stress, implying that there has been high leveraging by the concerned developers who have either limited or extremely poor visibility of debt servicing due to multiple factors.

Shobhit Agarwal, MD & CEO - ANAROCK Capital says, “COVID-19 has had a cascading impact across sectors, and ‘severely stressed’ loans levels in Indian real estate were expected to go up substantially. However, real estate – particularly the residential segment - has fared better than anticipated. Towards 2019-end, of the total real estate loan of USD 93 bn, at least 16% was severely stressed. Despite the devastation of the pandemic over the last one year, only 18% of the total USD 100 bn loan value falls under this category. This is definitely far better than other major sectors such as telecom and steel.”

“Moreover, the entire ‘severely stressed’ loan value in real estate is spread across more than 50 developers," says Agarwal. "In telecom and steel, default by a single company equals a sizable portion of the overall stress in the real estate sector. Also, every real estate loan is backed by hard security, which is anywhere between 1.5 to 2 times. Even if the loan is NPA, there is enough security for the lenders to recover a significant portion of their money.”

The overall contribution of NBFCs and HFCs (including trusteeships) towards the total lending to Indian real estate is at 63%. Individually, banks accounted for the largest share of total realty loans with 37%, followed by HFCs with approx. 34%, and NBFCs have 16% and 13% loans given under trusteeships. Interestingly, since 2013, the share of NBFCs and HFCs has grown considerably - at the expense of banks. However, in the past 4-8 quarters, banks have been more active than NBFCs.

Of these, banks and HFCs are much better placed with 75% and 66% of their lending book in a comfortable position. Not surprisingly, nearly 46% of the total NBFC lending is on the watchlist.

Realty Loans Breakdown by City & Developer-type

About 75% of the total lending to Grade A developers is safe. This presents a comfortable outlook because out of the total loans given to real estate, more than USD 73bn is given to Grade A builders. Of this, USD 55bn is safe and under no stress.

On the other hand, a high amount of realty loans given to Grade B and C developers needs strict monitoring. Close to 55% of the loans given to Grade B developers is under ‘severe’ stress; for Grade C developers, it is over 73%.

In terms of cities, Pune and NCR are both high on stress with 40% and 39% respectively of the total loan given to them, followed by Mumbai with 37%. Hyderabad, Kolkata and Chennai are well placed with just 3-4% stress (however, their overall share of the pie is limited). Bangalore with a 15% share of overall lending has 76% book with no stress at all.

Above views are of the author and not of the website kindly read disclaimer

More News

Quote on?Trade Data by Ms. Deepali Agrawal, Deputy Managing Director, India Exim Bank

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">