$40 bn Nvidia-Arm chip deal falls apart amid regulatory hurdles

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

In a massive blow to Big Tech, graphics chip giant Nvidia on Tuesday finally scrapped the $40 billion deal -- the biggest ever in the world of semiconductors -- to acquire British chip designer Arm, amid anti-trust probes in the US and Europe.

Nvidia and Softbank (which owns Arm) agreed to terminate the agreement because of "significant regulatory challenges preventing the consummation of the transaction, despite good faith efforts by the parties".

Softbank also announced that, in coordination with Arm, it will start preparations for a public offering of Arm within the fiscal year ending March 31, 2023.

"Arm has a bright future, and we'll continue to support them as a proud licensee for decades to come," said Jensen Huang, founder and CEO of Nvidia, adding that he expects Arm to be the most important CPU architecture of the next decade.

Under the terms of the agreement, SoftBank had already received a deposit of $1.25 billion during the signing.

In accordance with the terms of the agreement, Softbank will retain the $1.25 billion prepaid by Nvidia, which will be recorded as profit in the fourth quarter, and Nvidia will retain its 20-year Arm license, said the companies.

"Arm is becoming a centre of innovation not only in the mobile phone revolution, but also in cloud computing, automotive, the Internet of Things and the metaverse, and has entered its second growth phase," said Masayoshi Son, Chairman and CEO of SoftBank Group Corp.

"We will take this opportunity and start preparing to take Arm public, and to make even further progress."

Arm CEO Simon Segars will lose his job to Rene Hass, who ran Nvidia's own Arm business many years ago.

The US Federal Trade Commission (FTC) in December sued to block Nvidia's $40 billion acquisition of Arm from Softbank on antitrust grounds.

The deal faced scrutiny from regulators since it was announced last year.

"The proposed vertical deal would give one of the largest chip companies control over the computing technology and designs that rival firms rely on to develop their own competing chips," the FTC had said in an announcement.

Arm is a core supplier of architecture technology to most semiconductor companies. Its Arm instruction set is at the core of nearly all mobile processors powering smartphones, including those made by Apple and Android devices that use Qualcomm chips.

But the company's role in the chip industry was historical as a neutral supplier, raising concerns that Nvidia could cut off competitors from essential Arm technology.

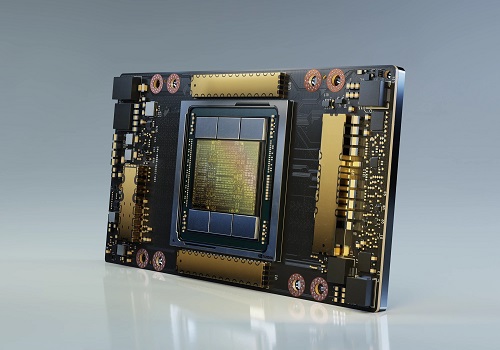

Some of Nvidia's processors also use Arm-designed cores and its Arm architecture, although the company is best known for graphics processors, which use different architecture.

FTC Chair Lina Khan, who was appointed by President Joe Biden to lead the agency shortly after her confirmation earlier this year, has signalled an interest in more robust antitrust enforcement.

The European Commission in October opened an in-depth investigation to assess the $40 billion acquisition of Arm by Nvidia.