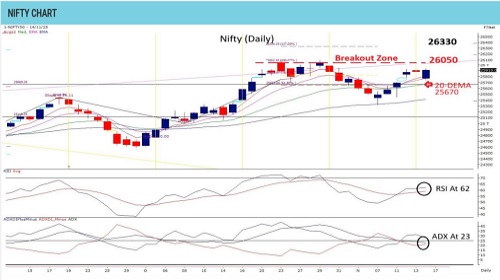

Nifty`s strong start; above 26050 can fuel a rise toward 26330 -Tradebulls Securities Pvt Ltd

Nifty

Nifty opened the week on a strong footing, and a decisive move above 26050 on an immediate basis is likely to further accelerate the uptrend towards 26330, aided by a potential short squeeze into the weekly expiry. The formation of a ‘Rising Three’ candlestick pattern on the weekly chart—appearing after the breakout above 25700—strongly signals continuation of bullish momentum. Momentum indicators support this strength as both daily indicators remain firmly aligned with the prevailing uptrend. On the downside, immediate support is seen at 25700, while the pattern support at 25440 remains crucial for maintaining the broader bullish structure. Options data reflects 25800 as the near-term base, while resistance for the week is likely near 26500 once above 26000.The market appears poised to accelerate its bullish momentum in the coming sessions. Traders may consider initiating aggressive fresh long positions above 26050, targeting 26330 initially, followed by 27000. Protective stops should be placed below 25440 for now and trailed higher as the trend advances to ensure effective risk management.

Please refer disclaimer at https://www.tradebulls.in/disclaimer

SEBI Registration number is INZ000171838

More News

Daily Derivatives Report 30 May 2025 by Axis Securities Ltd