MCX copper prices fell on Monday as a hawkish Federal Reserve dented demand for copper - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

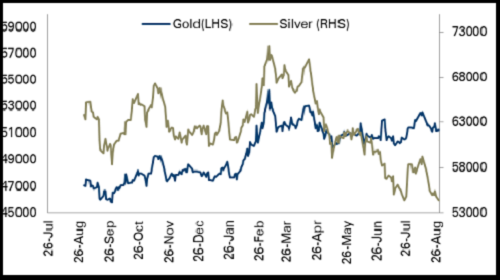

Bullion Outlook

* MCX gold prices advanced yesterday amid weakness in the US dollar index

* Moreover, growing fears of a global economic slowdown supported bullion prices

* MCX gold prices are expected to trade with a positive bias for the day amid a weak US dollar. MCX Gold prices are likely to surpass the hurdle of | 51,400 to continue its upward trend towards the level of | 51,550 in coming sessions

* Additionally, investors will closely watch JOLT job openings and CB consumer confidence data from the US

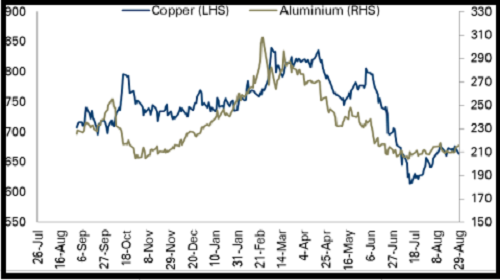

Base Metal Outlook

MCX copper prices fell on Monday as a hawkish Federal Reserve dented demand for copper

Further, expectations of rising interest rates may leading the global economy into recession, pressurised copper prices

However, further downside was restricted by a drop in copper LME warehouse inventories

MCX copper prices are expected to rise for the day amid a continuous drop in copper LME warehouse inventories. It is likely to trade in the range of | 666 to | 676 in the coming sessions

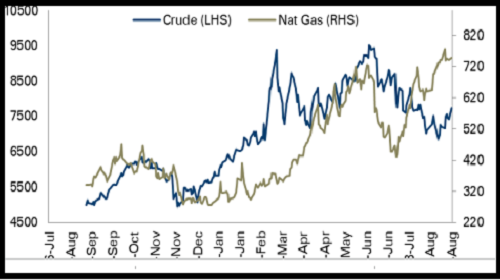

Energy Outlook

* MCX crude oil prices edged higher by almost 4.30% on Monday as Saudi Arabia, top producer in the Organization of the Petroleum Exporting Countries (Opec), last week raised the possibility of production cuts

* Further, unrest in Libya's capital Tripoli at the weekend, resulting in 32 deaths, sparked concerns that the country could slide into a full-blown conflict and disrupt oil supply from the Opec nation

* We expect MCX crude oil prices to trade with a positive bias for the day on concerns over a crude oil production cut by Opec. It is likely to trade in the range of | 7700 to 7900 in coming sessions

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631

Above views are of the author and not of the website kindly read disclaimer

Tag News

We anticipate immense potential benefits from the upcoming Sovereign Gold Bond Tranche in FY...