Auto Sector Update - 4W demand supply conundrum continues, 2Ws’ pain does not mitigate, tractors expect green shoots By LKP Securities

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

4W demand supply conundrum continues, 2Ws’ pain does not mitigate, tractors expect green shoots

We present an exhaustive Automobile Dealer Check conducted with the 2W, PV and tractor dealers across India covering all the geographic zones. Also we had a detailed discussion with the top notch personnel at FADA (Federation of Automobile Dealer Association) to gauge the current trends in the various segments.

We wanted to gauge the demand and production scenario post third wave and in the midst of semi conductor shortage crisis respectively.

Our discussions suggest exactly opposite trends in 2W and PVs demand and supply, while tractors are in slow lane, but expect green shoots shortly.

The month of February has been seasonally weak for most of the dealers/OEMs.

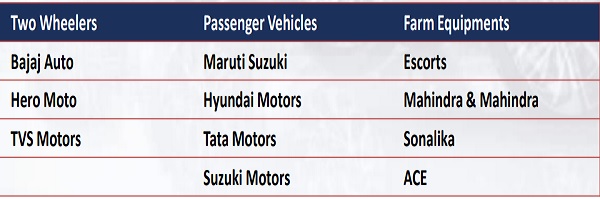

he dealerships of following companies were covered under our research

Impact of COVID 19 – A recap

Post Wave #1 of the pandemic we witnessed a complete lockdown in April and May of 2020, after which we witnessed a gradual opening up of dealerships and demand

Tractor demand immediately zoomed up (27% up in FY21) followed by 2W and PVs. CV demand was last to follow suit.

We saw a pent up demand in tractors, followed by 2Ws and PVs leading to a strongly revived H2 of FY21, while CVs started to revive in November, which grew well till March 2021, post which we witnessed the deeply penetrated intense and wide spread Wave#2 of the pandemic disturbing the entire industry.

Therefore post April and May even though the market started opening up, the industry did not revive as expected or in line with the Wave #1.

Post the peak of Wave #2, 2W demand started dipping month on month on higher acquisition cost, while PV supply started facing constraints related with the global semi-conductor chip shortage.

CV demand started zooming up, while tractors started slowing down on high base.

Our View

We believe that apart from 2Ws, things are not bad for the rest barring the supply issues for the PVs

2W demand may remain soft in near-midterm as affordability and rise in fuel prices have killed the demand across the country. The lower end is suffering to the maximum. With offices and colleges opening up demand for EV scooters may see some pick up.

Therefore Bajaj Auto is best pick among the 2Ws with more than 50% exposure to exports where there is a good demand especially in the developing markets of South East Asia, Africa and LatAm

As far as PVs are concerned, supply issue may take longer time to come back, however, it is difficult to project the timeframe. With demand expected to remain robust, we expect PVs to be the best placed segment in medium to long term and TaMo shall continue its excellent performance even better once the supply issue resolves. M&M and MSIL also shall see a good pick up in their numbers by then.

Tractors are also well placed to take advantage of the expected improvement in the rural economy though growing at a low pace on high base currently. Therefore M&M is our favorite pick which is well poised to take advantage of the rural story along with its rejuvenated UV, EV and CV stories and focused capital allocation strategy.

CVs are growing at a rapid pace and should continue to do so considering the higher thrust on Capex by the GOI. However, we see a cut throat competition in this sector which is resulting in lower profitability despite superb volumes. Therefore the player who sets its cost structure well in place to offset higher discounts shall be the winner. We like both TaMo and AL in this space.

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at www.lkpsec.com/#foo

Above views are of the author and not of the website kindly read disclaimer