#ShuruaatSIPse : SIP a smart goal based investment option

Have you ever wondered what`s the secret of wealth creation? The most common answer to this is ‘spending less than what you earn’. Well, the answer is only partly correct. Saving is important but how you deploy these savings into multiple investments options could well decide how you grow your wealth.

Money lying in a bank account or fixed deposit may not be the best way to manage your funds. Wealth creation means making sure that your money works equally harder for you and gives you optimum returns in long run.

The first step towards wealth creation is Setting Goals. If you are not working towards any goal then you’re likely to spend more, remember smart Investors always align all their investments with their Life Goals. Once you have decided upon the cost of your goal say child education, retirement corpus etc. then it’s time to plan your investments and calculate the SIP amount that you need to invest per month.

Goal Based Investments via SIP is one of the easiest and simplest way to invest and build portfolio. Investor invariably becomes disciplined, it allows investors to invest a fixed amount on a monthly basis or weekly basis and It is a planned approach portfolio building and create more wealth over the long term, it is similar to monthly EMI and one knows beforehand how much you need to keep aside before planning expenses. This works even better for millenials or new investors who have just started working as they may be tempted to spend.

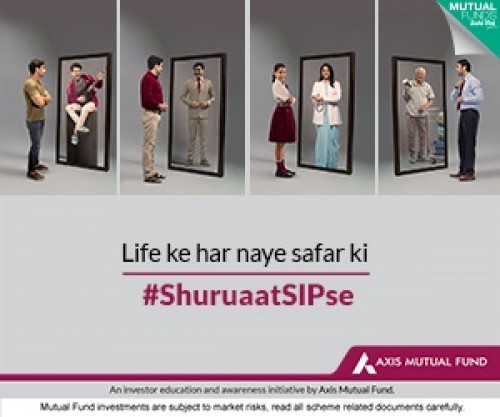

Here we would like to bring to our readers attention a brilliant campaign launched by Axis Mutual Fund #ShuruaatSIPse. The campaign encourages investors to build investment corpus basis the cost of funds required to fulfill their dreams and how much money they need to start investing over a period of time so that they can fulfill their dreams. The #ShuruaatSIPse campaign page is wealth of knowledge and it probably answers all the questions that an investor can have in his or her mind. Some of the basic questions like what is SIP ? That a first time investor can have to more mature questions like which fund do I start SIP in? Everything is answered and if you still have queries than you can talk to them.

The other benefit of SIP is that Investors can invest small amounts and build corpus for long term, remember Rome was not built in one day, investing is all about patience and staying focused on the long term goals set, so it’s not whether you have Rs. 500 SIP or 5,000 SIP per month, it’s all about investing regularly and you enjoying the power of compounding i.e. reinvesting the interest earned or returns earned on an investment so now your returns themselves start earning. Thus, you are effectively transforming your investments into an income generating asset.

Most importantly, with SIP as an investment tool investors can make market volatility their friend, Investorsdo not have to worry about timing the market, and because they invest regularly over a period of long term they benefit from rupee cost averaging and in this process average out the market.

SIP also helps to beat fear and greed cycle or emotions of investments, for instance In March, 2020 markets corrected sharply because of pandemic and lockdown there was an element of fear in the markets and not many investors would have taken advantage of the correction however all the SIP investors would have benefited as by default they would have bought units of mutual fund.

Undoubtedly, SIP is powerful yet simple way to invest in stock markets and everyone can see their dream come true with Goal based investments. SIP helps investors grow their portfolio in an discipline and hassle free way.For more information about SIP we would highly recommend you #ShuruaatSIPse page by Axis Mutual Fund.

Disclaimer –

“This is an investor education and awareness initiative by Axis Mutual Fund. Investors have to complete one-time KYC process. Visit www.axismf.com or contact us on customerservice@axismf.com for more information. Investors should deal only with Registered MFs, details of which are available on www.sebi.gov.in - Intermediaries/Market Infrastructure Institutions section.”

Mutual Fund investments are subject to market risk, read all scheme related documents carefully.