Index continues to gyrate around the 15000 mark as volatility index remains - Tradebulls

Nifty

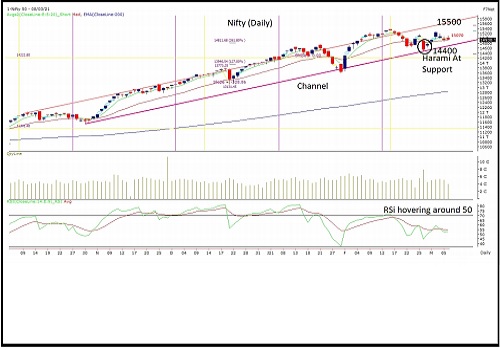

Index continues to gyrate around the 15000 mark as volatility index remains inclined around its upper bound of the range. On the other hand the broad trend for the Nifty remains bullish as the index remains locked-in within the thresholds of its ‘Rising Channel’ pattern. The recent occurrence of the ‘Bullish Harami’ formation reconfirmed the pattern support at 14400; as the index saw a swift bounce back from the same. Post that narrow ranged candles during the week depict the subdued price action during the session; as most part of the volatility gets addressed during the opening session which primarily depends on the global developments. For the current truncated week its ideal to expect continuation of the ongoing consolidative move with bounds been placed around 14500-15500 with 15070 being a momentum gauging zone within the range. Traders should remain vigilant, retain low leverage trades & continue with long short pairs as the stock & sector rotation remains healthy.

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://www.tradebulls.in/Static/Disclaimer.aspx

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

More News

Buy Crudeoil Mar @ 6100 SL 6020 TGT 6180-6250. MCX - Kedia Advisory