No Record Found

Latest News

Nifty OI Snapshot: 26000 CE Tops 25000/25500 PE Key ...

Bill Gates to visit Andhra Pradesh today

Nifty May Slide to 25270?25150; 20-Day SMA at 25450 ...

The Index started the week on a positive note - ICIC...

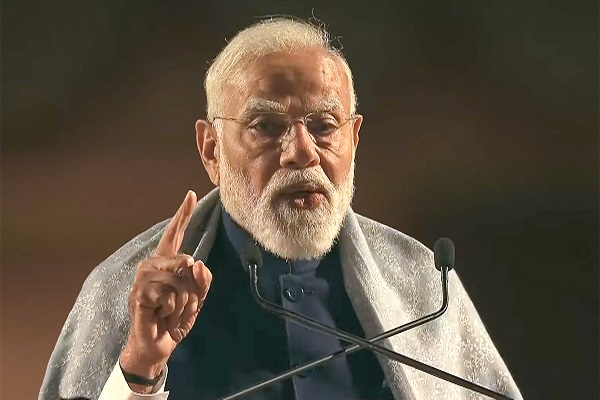

'Matter of pride that people from all over world are...

.jpg)

Morning Glance - 16 February 2026 - ARETE Securitie...

Startups to drive innovation, boost India?s research...

Nifty 50 is poised for a cautious week and is likely...

India-UK free trade agreement likely to be implement...

Oil drifts ahead of US-Iran nuclear talks

Top News

News Not Found

Tag News

News Not Found

More News

News Not Found