No Record Found

Latest News

Prime Minister Narendra Modi highlights success of A...

India Strategy : Trade Breakthroughs and 16% Earning...

COAS General Upendra Dwivedi flags off Bharat Rannbh...

Congress?s Shama Mohamed says Prime Minister Modi?s ...

Automobiles Sector update : Wholesales continue to r...

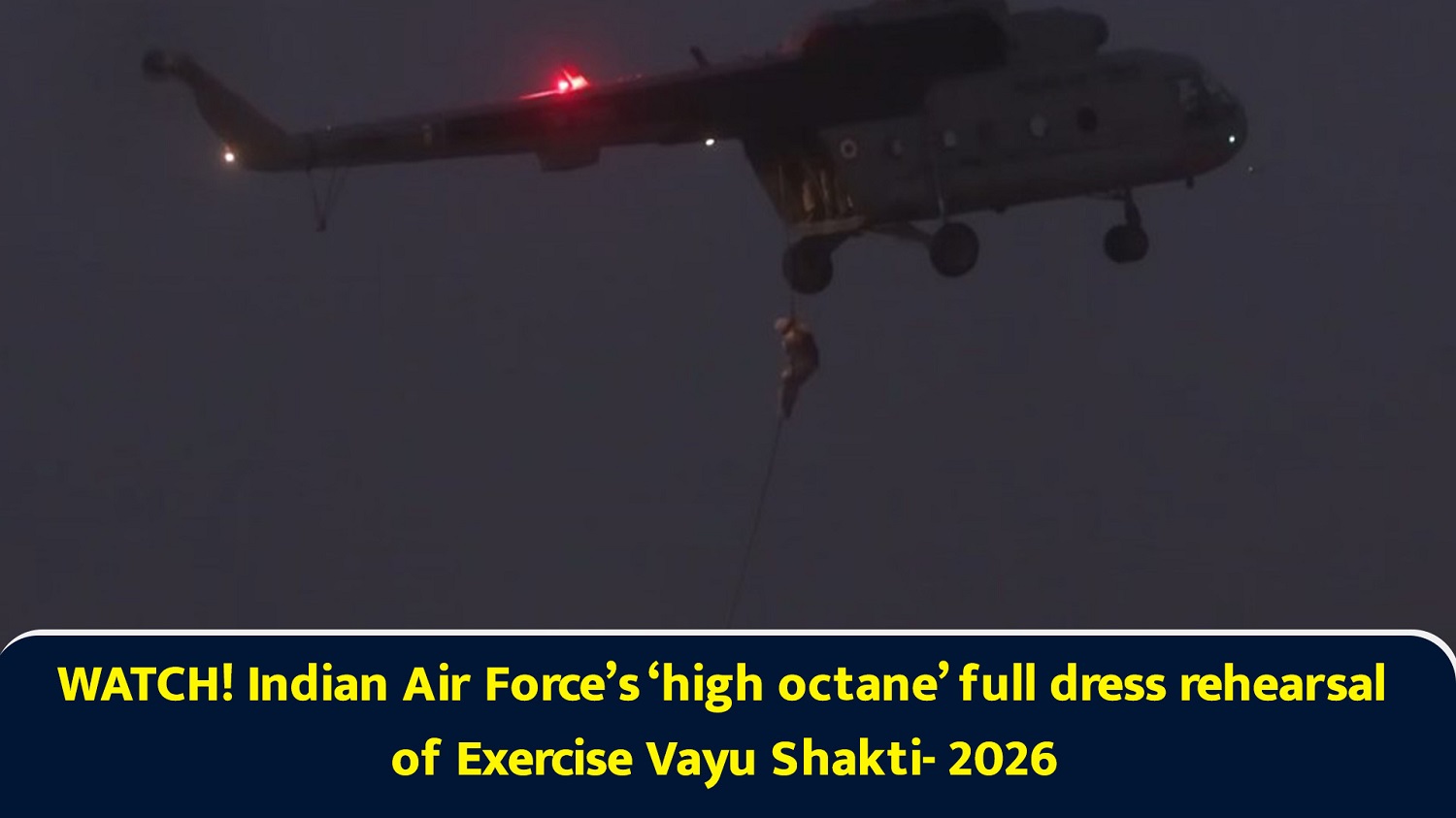

WATCH! Indian Air Force?s ?high octane? full dress r...

AI pact between Italy, India and Kenya to boost incl...

Cabinet enhances equity investment limit of POWERGRI...

Buy Polycab IndiaLtd for the Target Rs.9,600 by Moti...

BUY DHANIYA APR @ 11200 SL 11000 TGT 11500-11700. NC...

Top News

News Not Found

Tag News

News Not Found

More News

News Not Found