Monthly Newsletter and Commentary From The Desk Of Tata Mutual Fund CIO

Below are Views On Monthly Newsletter and Commentary From The Desk Of Tata Mutual Fund CIO

"When the facts change, I change my mind. What do you do, sir?" – John Maynard Keynes

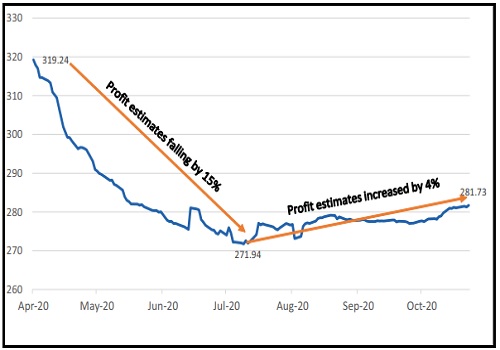

India's Covid peak (of the first wave at least) is over and economic recovery is surprising on the upside. Some of the high frequency indicators have been trending positive for some time and now the commentary from corporates are confirming the same. As a result, after a cut in profit forecast for the BSE 200 companies of around 15% since the beginning of the lockdown, the estimates have looked up by 4% since the bottom in July. And there could be more to come in the second half of the year. As you can notice, the focus is on next fiscal year and not the current year which has been impacted more sharply but is also seeing a recovery.

S&P BSE 200 EPS Forecast for fiscal year 2021-22

This incidentally is the first time in the last 4-5 years that profits might get upgraded in the second half of the fiscal. Usually its been the case of starting with higher expectations of say a 20% profit growth and a constant downward revision throughout the year, ending with a flat or paltry profit growth. So, what explains this turnaround. In simple terms it is a function of the following factors.

* Cost cuts: What started as involuntary cost cuts due to lockdown has now provided corporates an opportunity to examine all costs and eliminate certain costs on long term basis also. Most of the corporates are now guiding towards the fact that about 30-50% of the cost cuts will stay for longer period post recovery from Covid also. The result has been almost a uniform trend across manufacturing/services/industrial companies of profit margins surprising positively despite the topline pressure. Impact of prolonged lockdown was difficult to forecast anyway and in hindsight it seems like analysts had taken an extremely cautious approach on margins

* Consumption trends: Rural markets were anyway faring better in lockdown and urban demand has come back as consumers adjusted to new mode of transacting. The rebound in number of e-way bills electricity demand and now GST (even if partly due to pent up demand) is impressive. Recent commentary from banks also indicate a pick-up in retail demand which is also driven by lower interest rates (in housing and vehicle finance).

* Banking system stress – not as bad as feared: More recently, what is becoming evident is that the Covid-related bad loans may not exceed 3-4% in well managed banks, well short of the 7-10% which was being feared earlier. In other words, what the banks have provided as credit costs for Covid related stress till now will be enough. It should also be remembered that cut in profit forecasts for banks was more severe than the rest of the market and it extended into FY2-22 as markets assumed higher credit costs in the next 12-18 months. If the current credit provisions are enough, we are beginning to see upgrades in profits which can be equally sharp.

However, amongst all the cyclical recovery in banks and industrials on margin and profit recovery, one should not lose sight of the structural factors that have lifted the profit outlook for certain sectors like IT, pharma as well as niche opportunities as identified by the "Business Thermals" in our previous newsletter (Why do Eagles Fly in Circles). Structural driver of earnings for these sectors coupled with cyclical upswing in profits (based on better profit margins, lower banking system stress) can create a significant swing in overall corporate profitability (Nifty 50 / S&P BSE 200).

Lastly, I want to wish our readers and investors a very happy, safe, and prosperous Diwali.

Above views are of the author and not of the website kindly read disclaimer