Indian markets could open flat, in line with the combined impact of Asian markets over today and previous day and that of US markets over Thursday and Wednesday - HDFC Securities

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

Indian markets could open flat, in line with the combined impact of Asian markets over today and previous day and that of US markets over Thursday and Wednesday : HDFC Securities

U.S. shares rebounded on Thursday after falling for three consecutive days and benchmark Treasury yields dipped, as investors snapped up stocks that would benefit from an economic recovery and shrugged off worries about rising prices, for now.

Investors focused on U.S. weekly data on jobless claims, with applications for first-time benefits falling to a pandemic low of 473,000 in the week ended May 8 (a 14 month low) and took another round of U.S. inflation data in stride on Thursday, with stocks rising after April producer-price index jumped 0.6%, far above forecasts for a 0.3% rise. Year over year, wholesale inflation rose 6.2% versus a 4.2% rise in March.

Oil futures fell sharply Thursday, snapping a four-day winning streak to settle at their lowest price so far this month, as the Colonial Pipeline resumed operations after shutting down late last week in response to a ransomware attack.

Economic activity in Brazil fell in March, a central bank index showed on Thursday, the first decline in 11 months due to lockdowns to counter a second wave of the COVID-19 pandemic, but a far smaller decline than economists had expected. The IBCBr index fell a seasonally adjusted 1.59% in March. According to Refinitiv data, that was the eighth steepest fall since the series began in 2003

U.S. stock indexes closed sharply lower Wednesday, after a reading on inflation for the year to April climbed 4.2%, the highest rate in about 13 years, reigniting fears that the Federal Reserve may need to dial back its easy-money policies earlier than expected. Trading on Wednesday was punctuated by heavy selling in technology shares, while the Dow Jones Industrial Average suffered its biggest one-day percent decline since Jan. 29.

The U.S. consumer-price index rose 4.2% from a year ago, compared with average economists estimates surveyed by Econoday for a 3.6% increase. The month-over-month rise was 0.8%, versus a forecast for a rise of 0.2%. Overall, the rise showed the fastest rate of climb since September 2008

India’s industrial output in March was 22% higher than a year ago when the country had been forced into a nationwide lockdown. The data, which comes with a two-month delay, is yet to reflect the impact of the second wave. The Index of Industrial Production rose by 22.35% in March 2021 over last year, compared to a drop of 3.4% in February, according to revised estimates. Thirty two economists polled by Bloomberg had forecast March IIP growth at 20%.

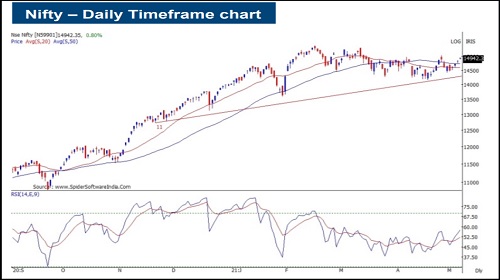

Daily Technical View on Nifty

Observation

Markets corrected on Wednesday for the second consecutive session. The index opened on a weak note and proceeded to move lower through the session. The Nifty finally lost 154.25 points or 1.04% to close at 14,696.5. Broad market indices like the BSE Mid Cap and Small Cap indices lost less, thereby out performing the Sensex/Nifty. Market breadth was negative on the BSE/NSE.

Sectorally, the top gainer was the BSE Auto index. The top losers were the BSE Metal, Bankex and Oil and Gas indices.

Zooming into the 15 minute chart, we can see that the Nifty opened lower and continued to move lower through the trading session. In the process, the index also broke the previous swing lows of 14765, implying that the very near term trend has turned down.

On the daily chart, the Nifty continues to hold above a rising trend line that has held the important lows of the last few months. This implies that the index remains in an intermediate uptrend. The Nifty has also made a higher bottom at 14416 which gives further evidence of an uptrend.

We therefore expect any corrections to find support above the 14416 levels.

Conclusion: The 1-2 day trend of the Nifty is now down with the index breaking the previous swing low of 14765.

On the larger daily timeframe, an upward sloping trend line continues to support the index with the Nifty also making a higher bottom at 14416 which gives further evidence of an uptrend. We therefore believe that any corrections could find support above the 14416 levels before resuming the uptrend.

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ000171337

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

Nifty registers best week in 2 months after rising for 6 consecutive sessions

More News

Weekly Market Outlook : The domestic market witnessed a broad-based rally during the week Sa...