Views On Equity Outlook : Feb 2021 By Sorbh Gupta, Quantum Mutual Fund

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

Below are Views On Equity Outlook : Feb 2021 By Sorbh Gupta, Fund Manager –Equity, Quantum Mutual Fund

Equity Outlook : Feb 2021

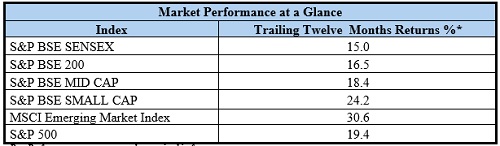

S&P BSE Sensex declined by -3.05% on a total return basis in the month of January. On trailing twelve month basis the index has returned 15.04%. S&P BSE Sensex performance was worse than developed market indices such as S&P 500, which declined by -2.18% during the month. It was also worse than the MSCI Emerging Market Index which rose by 2.7%.

Mid-cap and Small-cap indices outperformed the Sensex in January; with the S&P BSE Mid-cap Index rising by 0.78% and the S&P BSE Small-cap Index declining much lower by -0.55%. Auto, IT, telecom & capital goods, were the winning sectors for the month. Auto stocks have rallied on the back of good monthly volume numbers and strong third quarter results. IT stocks too reacted positively to their earnings release & positive commentary on demand. Healthcare, banking & metals stocks underperformed during the month.

Union Budget 2021: Borrowing for growth

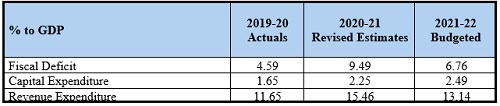

The pandemic & lockdown hit Indian economy wanted a push for both capital & consumption in this budget. Through the provisions of the Union Budget 2021-22 government has targeted increased spending on infra & other capital expenditure to kick start the economy but, as has been the cases in multiple rounds of stimulus announced last year, there is very little to boost consumption. On the contrary, the new ‘agriculture infrastructure cess’ on petrol & diesel is inflationary and has potential to reduce real income of the households thereby impacting near term consumption.

This time the government has followed a fiscally expansionary path to put the economy back on track. Though, the headline budgeted fiscal deficit numbers for FY21 & FY22 looks higher due to reclassification of NSSF [National Small Savings Fund] loans to FCI above the line. Higher borrowings (even after adjusting for reclassification of FCI loan) by the government can crowd out the private sector demand for loans, until & unless, foreign flows in debts come to their rescue. There have been some sector specific changes like change in FDI limit in insurance & scrappage policy for autos which augurs well for respective sectors. There were no significant changes on direct taxes. Overall, the government’s planned spend on infra, if executed properly, has the potential to increase employment & expedite (though, boost to consumption would have expedited it much faster) the natural business cycle to revive corporate earnings which otherwise shall be a gradual process.

FII Flows: Inflows have continued in the New Year.

Indian Equities have seen $1.9 bn of net buying by foreign investors in the month of January 2021. This is on the back of US$ 23 bn of FII flows in CY2020. The last two months of CY20 has seen FPI inflows of US$ 8.5 bn. DIIs have been large sellers for four months now. In January they have sold USD 1.37 bn worth of stock. Indian rupee was flat during the month. India with a recovering economy is moving back to a higher nominal growth trajectory vs. the western world (which continues to struggle with 2nd & 3rd wave of Covid and related lockdowns) and looks as a credible destination for yield & growth seeking developed world investors. This means strong FII inflows can continue.

Covid 19: No resurgence after first wave, vaccination drive starts.

India’s Covid related data points (as given above) are comforting. Despite opening up of economy & increased mobility, daily new infections have shown a sharp deceleration & so far there are no signs of a second wave. Government has approved Oxford-AstraZeneca (manufactured by Serum Institute India), & Bharat Biotech’s (Local player) vaccines for India. Vaccination has started from Jan 16, 2021 and so far 4mn frontline health care workers have been inoculated. Government plans to vaccinate 300mn people by August 2021.

Quantum Long Term Equity Value Fund saw a 1.06% appreciation in its NAV in the month of January. This compared to a –1.95% decline in its benchmark S&P BSE 200. Outperformance for the month was driven by holdings in, Auto, IT and select NBFCs. Cash in the scheme stood at approximately 6% at the end of January.

Past performance may or may not sustained in future.

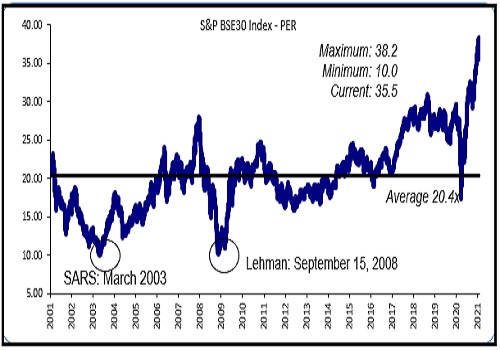

S&P BSE Sensex valuations, based on current year earnings are at a twenty year high. Even after normalising for very weak first quarter earnings (due to covid-19 induced lockdown) the benchmark indices look richly valued. From here on, the equity return will be driven by earnings upgrades cycle of corporate India, as recovery gains momentum. Any risks to the economic recovery can result in sharp correction. The government’s fiscal expansion driven spending is focussed on capital expenditure rather than consumption boost. Theoretically speaking, a capital expenditure driven economic momentum is more sustainable but it often takes more time than consumption driven boost & entails more execution challenges. We remain constructive on Indian equities with longer-term view & suggest a neutral weight. Given the sharp run-up, we believe any fresh allocation toward equities should be staggered or through SIP route.

Above views are of the author and not of the website kindly read disclaimer

Tag News

We anticipate immense potential benefits from the upcoming Sovereign Gold Bond Tranche in FY...