India today shows a picture of optimism and resilience: RBI Governor

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

Retail CBDC pilot to be launched in late November

e-Rupee launch a landmark moment

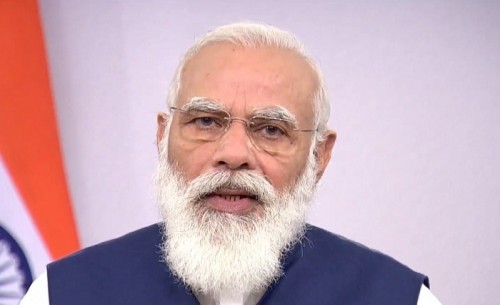

Reserve Bank of India Governor, Mr Shaktikanta Das, noted that country's macroeconomic indicators and buffers today make "India a picture of optimism and resilience." He was speaking at FIBAC 2022 – an Annual Banking Conclave organised jointly by FICCI and IBA.

Speaking on inflation, the RBI Governor acknowledged that the inflation targets were missed to avoid 'paying a high cost' by tightening earlier. He said, "we did not want to upset the process of recovery. We wanted the economy to safely reach the shores and then bring down inflation." He noted that RBI continues to be watchful of the liquidity situation, noting, "RBI remains agile and watchful and ready to undertake liquidity operations.”

Mr Das added that the launch of Central Bank Digital Currency (CBDC) is a landmark moment in the history of money and currency in the country. "Going forward, it is going to be a major transformation of the way business is done, the way transactions are conducted," he said. Mr Das noted that Reserve Bank is among the few central banks in the world that have taken this initiative. He said that RBI will launch the retail part of the CBDC trial later this month.

He also spoke on end-to-end digitised KCC loans launched last month in Madhya Pradesh and Tamil Nadu. He underscored that the learnings from the pilot project and the CBDC pilot will be used to 'launch the CBDC in a full-fledged manner in the near future.' In addition, RBI will use the learnings in launching pilots for SME loans. "If everything goes alright, we hope to do launches nationwide sometime during the year 2023," he said.

Addressing the volatility in the exchange rate, RBI Governor said that almost all major currencies - barring the Swiss Franc, the Singapore Dollar, the Russian Rouble and the Indonesian Rupiah - have depreciated against the US dollar more than the Indian Rupee. He said, "from April 1 to October 31, 2022, the Indian Rupee has depreciated by 8.0 per cent, while the US dollar has appreciated by 13.0 per cent." In addition, Mr Das underlined that the Indian Rupee has appreciated against many major currencies. Furthermore, he added, "the size of the Indian Rupee's appreciation was the highest vis-à-vis the Japanese Yen (12.4 per cent), the Chinese Yuan (5.9 per cent), the Pound Sterling (4.6 per cent) and the Euro (2.5 per cent)."

Speaking on occasion, Mr Sanjiv Mehta, President, FICCI, underscored the need for a sustainable, inclusive growth of almost 8 per cent per annum for the next few decades to realise the vision and aspirations of 1.4 billion Indians. "The financial sector will, of course, have a key role to play in this journey," he said.

Alluding to the challenges faced by MSMEs in getting credit, Mr Mehta suggested that Credit Bureau / Credit Registry could evolve into comprehensive consent-driven information Bureau(s) leveraging the Account Aggregator framework.

In his welcome address, Shri A K Goel, Chairman, IBA and Managing Director & CEO, Punjab National Bank, noted the adoption of various technology developments like artificial intelligence, machine learning, cloud computing, blockchain technology by banks has enabled them to improve their product and service offerings and customer experience. He also alluded to fintechs and noted, "fintechs not as competitors to banks, but as equal partners."

Mr Saurabh Tripathi, Managing Director & Senior Partner, BCG, alluded to the need for proactive action in light of what the industry might look like in five years and suggested enhancing the current Aadhar KYC system on the lines of Singapore that allows for KYC with just a facial ID. In addition, he underlined the need for the digitisation of secured credit and suggested extending support to 'tokenisation of real assets'.

Mr Sunil Mehta, Chief Executive, IBA delivered the concluding remarks and appreciated the issues raised by the RBI Governor and other speakers on the occasion.

Mr Arun Chawla, Director General, FICCI also spoke at the event and delivered the vote of thanks.

The FIBAC 2022 report Riding India's Digital Super-Cycle was also released during the event.