Japanese Yen gets the spotlight amidst all the global humdrum By Heena Naik, Angel One Ltd

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

Below are View On Currency 23 June 2022 by Heena Naik, Research Analyst - Currency, Angel One Ltd

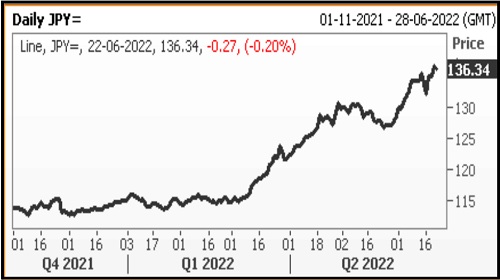

There is a lot of talking happening about the Japanese Yen lately. The currency has weakened by more than 15 percent in 2022, which is huge! So, what led the Yen to weaken so much? And what is the Bank of Japan doing for arresting the fall in the Yen? Before diving into the much-asked questions, it is important to understand the economic hiccups that Japan is facing.

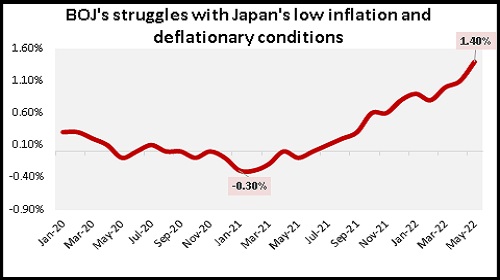

Japan is struggling with multiple issues at present. From weakening currency to growth and inflation problems, the country surely has a lot on its platter to deal with. Starting with inflation, one of the major issues Japan has been facing is a low level of inflation-cum-deflation since its crisis in 1989. It is very doable for a central bank to calm down a country’s inflation, but it is difficult for them to get the country out of deflation. Bank of Japan has tried everything from negative interest rates to large-scale monetary stimulus to bring out Japan from the clutches of deflation but with no luck.

Daily JPY

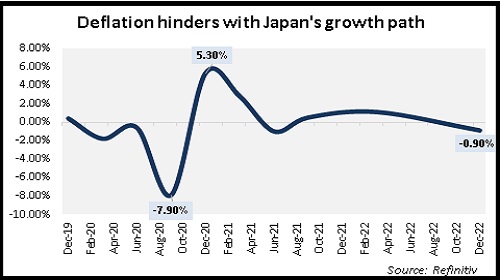

The problem with deflation is when prices for everyday items don’t increase, people tend not to increase their spending. This sluggish demand deters companies from earning substantial profits which prompts them to not hikes wages for their workers. Less income means less spending, this intensifies the deflation problems which hampers economic growth as well. The economic activity in Japan has remained persistently weak for quite some time. The deflationary mindset has hindered Japan’s productive capacity and growth rate over the past 30 years.

Deflation hinders with Japan's Growth path

From the inflation chart, it is quite visible that Japan’s inflation in 2020-2021 was in a deflationary range as the inflation numbers turned negative due to the pandemic. It was only in 2022, that the prices started to surge which pushed the CPI to 1.4 percent in May’22 from -0.30 percent in Jan’22. The surge in consumer prices in 2022 was mainly due to a global increase in prices for raw materials and energy. Japan recorded its largest current account deficit since the start of 2014 in January as a jump in oil import costs offset gains in investment incomes along with continuing uncertainty surrounding the Ukraine crisis and Covid-19 Pandemic. The BoJ gov stated that the committee will carefully monitor how escalating tensions in Ukraine could affect oil prices given Japan's heavy reliance on energy imports.

The Bank of Japan cannot hike rates to curb inflation unlike other central banks such as the US, BOE, India, etc. The gap in interest rates between Japan and other major economies like the U.S. has weakened the Japanese Yen sharply due to the interest rate differential. USDJPY has surged by more than 15 percent in 2022. With respect to JPYINR, the pair has fallen by more than 12 percent. In the coming days, USDJPY Spot (CMP: 136.19) is likely to remain in the bullish territory for some more time. Whereas JPYINR is likely to fall towards 55 levels, the break of the same could push the currency towards 53 levels.

BOJ's struggles with Japan's low inflatio and deflationary conditions

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://www.angelone.in/

SEBI Regn. No.: INZ000161534

Above views are of the author and not of the website kindly read disclaimer

Tag News

Quote on Silver : Silver price falls in recent weeks Says Prathamesh Mallya, Angel One