Outlook on Gold by Mr. Mahesh Kumar, Abans Group

Below is Outlook on Gold by Mr. Mahesh Kumar, EVP & Head Capital & Commodities Market (Abans Group)

Dovish comments from Fed to keep gold prices higher in the near term

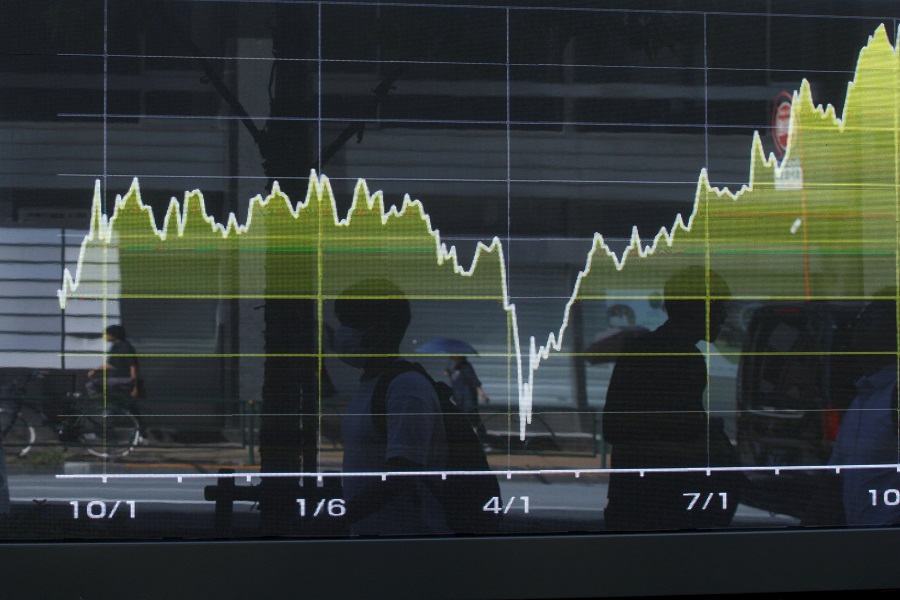

Gold prices rose from a low of $1785.20 on Friday and continued their upward trend on Monday, reaching a high of $1826.3 in the early morning session. Gold prices are expected to rise due to a drop in the dollar index and Fed Chair Powell's dovish tone.

For more than a year, the Federal Reserve's bond-buying program — as well as massive government expenditure worth trillions of dollars — offered essential support and helped drive gold prices higher. Jerome Powell, the chairman of the US Federal Reserve, said the central bank will take its time winding down its ultra-loose monetary policy and was not in a rush to raise interest rates.

On the economic front, US personal expenditure climbed +0.3 percent m/m in July, missing estimates of +0.4 percent m/m. In addition, consumer sentiment at the University of Michigan increased by 0.1 to 70.3 in August, above estimates of 70.8. Personal income increased by +1.1 percent m/m in July, exceeding estimates of +0.3 percent m/m for the first time in four months. Also, the July core PCE deflator increased by +0.3 percent m/m and +3.6 percent y/y, which was in line with predictions, despite the +3.6 percent y/y increase being the biggest in 30 years. For gold prices, the economic data from the United States was generally mixed.

The global spread of the delta Covid version, which is expected to slow global economic development this year, is also helping gold prices. According to the latest data from Johns Hopkins University's Coronavirus Resource Center, the number of coronavirus infections diagnosed worldwide has topped 216.3 million, with the global Covid-19 death toll standing at over 4.5 million. In the United States, the daily average of new Covid-19 cases has climbed to over 151,000, and more than 48% of the population has not been adequately vaccinated. Because of the development of Covid-19, the European Union is expected to urge that nonessential travel from the United States be halted.

According to the Commitments of Traders report from the CFTC for the week ending August 24, net long gold futures increased by 4464 contracts to 210653 for the week. The speculative long position climbed by 14647 contracts, while the speculative short position decreased by 4464 contracts. Last week's rise in gold prices might help net longs in the coming week.

Gold prices are likely to continue solid when trading above the 20-day EMA's important support level of $1797.56, but they may confront significant resistance between $1834-$1850.

Above views are of the author and not of the website kindly read disclaimer

Tag News

More News

China`s Soybean Imports Surge Toward Record Annual High by Amit Gupta, Kedia Advisory