Budget Strategy - Nifty index has taken a pause in positive momentum after a strong rally By Motilal Oswal

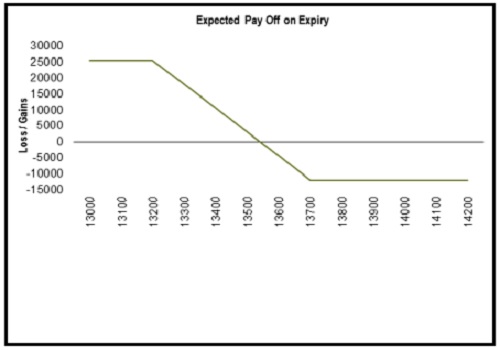

Nifty index has taken a pause in positive momentum after a strong rally of last 10 months from 7511 to recent life time high of 14753 marks. Index started to form lower top - lower bottom on daily scale and bounces are being sold which indicates that now upside hurdles are already marked before Budget 2021. However, major trend of the Indian market remains bullish but short term trend has taken a pause and profit booking decline is already seen from last five trading sessions. Ahead of such a volatile event better to go for hedging strategy to protect long portfolio as index has already rallied by 96% from its March panic low of 7511 marks. One can go for Bear Put Spread (+13700 PE - 13200 PE) in 25th Feb 2021 monthly series at premium cost of around 1.15% to protect the downside of 5% till the key major support of 13200- 13131 zones.

NIFTY : BEAR PUT SPREAD

For Hedging till 13200 zones for entire Feb month

Buy 1 lot of 13700 Put @ 300

Sell 1 lot of 13200 put @ 140

Premium paid : 160

Max Risk : 160 (Rs. 12000/-)

Max Reward : 340 (Rs. 25500/-)

Expiry date: 25th Feb,Monthly Expiry 2021

Nifty

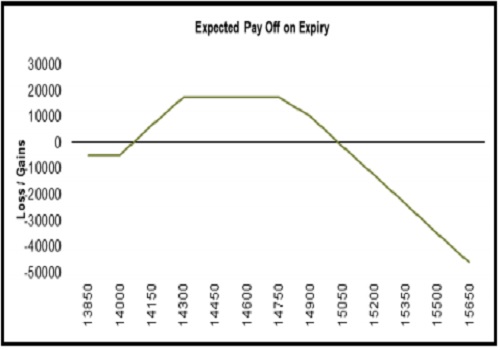

Nifty index has already seen a decline of more than 1000 points in just five trading sessions and now trading near to its 50 DEMA. As per recent price and data setup, short term trend is in pressure but after the profit booking decline from higher zones and support near to key moving average may help for a bounce back move towards 14300 zones. So we suggest for a bounce back strategy with view that upside is capped but some bounce could happen in such market which already seen decline before a key event. We are suggesting a bounce back strategy in weekly series with Bull Call Ladder Spread (+14000 CE - 14300 CE - 14800 CE) at premium cost of 65 points for a reward of 235 points if it bounces to 14300 zones.

NIFTY : Bull Call Ladder Spread

To play a small bounce with less premium cost in weekly series

Buy 14000 Call @ 230 Sell 14300 Call @ 130

Sell 14800 Call @ 35 Premium paid : 65

Max risk scenario 1 : 65 (Rs. 4875/-)

Max risk scenario 2 : Unlimited above 15035 (Less likely)

Max reward : 235 (Rs. 17625/-)

Expiry date: 11th Feb, Weekly Expiry 2021

To Read Complete Report & Disclaimer Click Here

For More Motilal Oswal Securities Ltd Disclaimer http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html SEBI Registration number is INH000000412

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer