No Record Found

Latest News

Market outlook: Quarterly earnings, inflation data, ...

S. Korea: Household loans by major banks rise in Jul...

Some conglomerates pay out dividends to owner family...

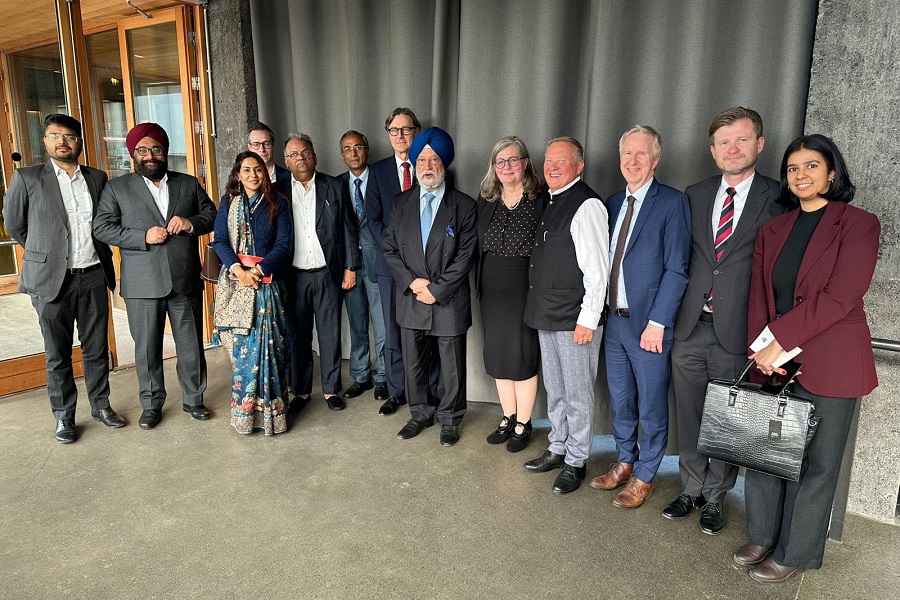

India and Iceland share common spirit of innovation,...

The Bank Nifty index is likely to face significant r...

Tripura exported 73.15 MT of pineapple in seven year...

GST Council meeting soon, tax slab rates and compens...

NABARD prepared to lead from front for India`s inclu...

India`s food delivery market to see 13-14 pc growth ...

The Potter Lifestyle: Crafting Clay, Crafting Life

Top News

News Not Found

Tag News

News Not Found

More News

News Not Found