Buy Kotak Mahindra Bank Ltd For Target Rs. 2,266 - LKP Securities

.....business growth best among peers

Result and Price Analysis

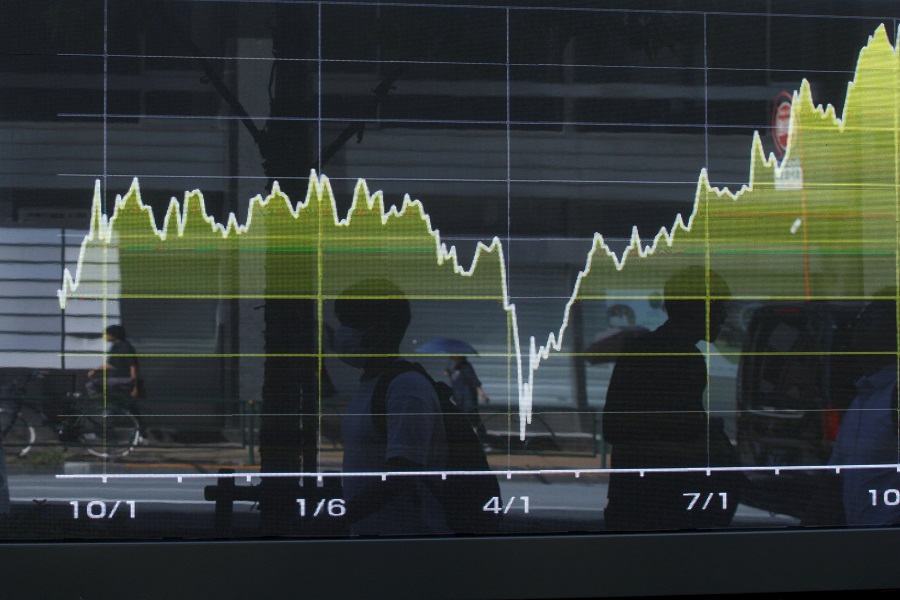

Kotak Mahindra Bank (KMB) reported superlative 4QFY22 results with the key pointers being: a) profitability rose because of strong NII (up 4.3% QoQ) and provision write-back, b) PPOP witnessed healthy growth because of higher treasury gains and lower operating expenses (C/I: 47% v/s 53% in 3QFY22), c) GNPA/NNPA ratio moderation to 2.34%/0.64%, d) restructured pool inched down to ₹12bn (44bps of advances) v/s ₹13.6bn in the previous quarter, e) credit off-take best among large private banks with growth of 22.5% YoY and 6.5% sequentially, f) covid provision held at ₹5.5bn as of 4QFY22, provision write-back worth ₹4.5bn, g) the total contingent provisioning (covid + Standard + Specific) stood 0.25% of net advances, h) Total PCR (including covid, general and specific provision) stood ~84 of NPL amount, g) Headline NIM inched up 16bps QoQ to 4.78%. We believe the bank’s profitability will be driven by higher growth, healthy margins, robust non-interest income and lower provisioning. We recommend BUY factoring a best in class ROA of more than 2%

Provision write-back led to healthy PAT growth: The provisioning expenses stood negative ₹3bn v/s negative ₹1.3bn in the previous quarter. Nevertheless, the bank has utilized covid provision worth ₹4.5bn in this quarter. Covid provision continued to be held at ₹5.5bn and total provisions (excluding PCR) stood 0.25% of loans. The covid provision (₹5.5bn) seems adequate for restructured book of ₹12bn. The 4QFY22 witnessed a better asset quality performance as GNPA/NNPA/PCR/SMA2 stood at 2.34%/0.64%/73%/0.07% against 2.71%/0.79%/71%/0.12% in the previous quarter. The GNPA/NNPA ratio decreased because of sequentially lower slippages (₹7.4bn v/s ₹7.5bn in 3QFY22) and higher write-offs (₹3.5bn v/s ₹3.4bn in 3QFY22). The absolute GNPA (₹64.7bn) and NNPA (₹17.3bn) decreased sequentially by 7% and 13% respectively. The SMA2 book decreased meaningfully to ₹1.8bn (7bps) v/s ₹2.9bn (12bps). The total restructuring amount (covid + MSME) moderated to ₹12bn (0.44%) against ₹13.6bn (0.54%) in 3QFY22. Out of which covid related restructuring is ~₹4bn and rest is MSME restructuring.

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at www.lkpsec.com/#foo

SEBI Registration number is INM000002483

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer