No Record Found

Latest News

AvenuesAI Limited`s Q3FY25-26 Results - Raises Full ...

Standard Chartered launches health and wellness offe...

Arihant Academy Q3FY26 PAT jumps by 60% to Rs.1.81 C...

CleverTap Recognized as a Leader in Latest Gartner M...

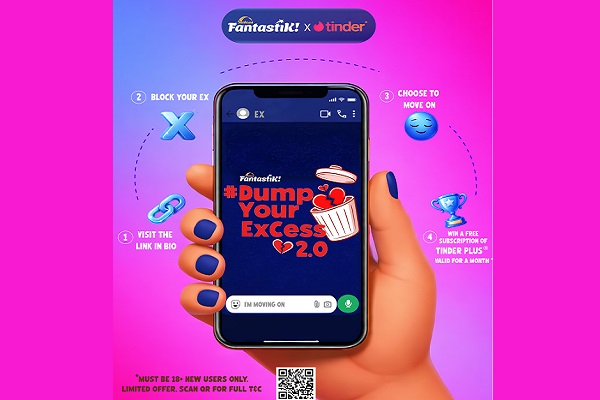

This V-Day Sunfeast Fantastik! Is Back with its Icon...

The CTO Evolution: Why India`s Tech Leaders are Resk...

mPokket Launches a New Brand Film Highlighting ``Why...

Beyond the Term Sheet: The New Playbook for India`s ...

Danube Properties Launches `Serenz by Danube? in JVC...

AI Thought Leader Dr. Vijay Gurbaxani Joins Critical...

Top News

News Not Found

Tag News

News Not Found

More News

News Not Found