No Record Found

Latest News

Sensex support is at 83300 then 83000 zones while re...

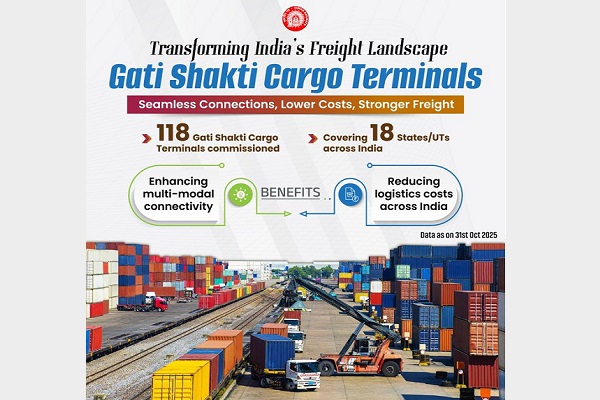

Railways record 4-fold jump in freight revenue from ...

Quote on Market Movement 14th January 2026 by Deveya...

.jpg)

Views on Morning Market 14th January 2026 by Dr. VK ...

Hyundai Motor aims to develop India into a `strategi...

Stock Picks : Tata Steel Ltd, Oil and Natural Gas Co...

BHASHINI provides AI language services to citizens t...

Industrial and warehousing leasing demand up 16 pc i...

Stock of the day : Tech Mahindra Ltd by Target Rs. 1...

Gold prices eye fresh record high, silver skyrockets...

Top News

News Not Found

Tag News

News Not Found

More News

News Not Found