No Record Found

Latest News

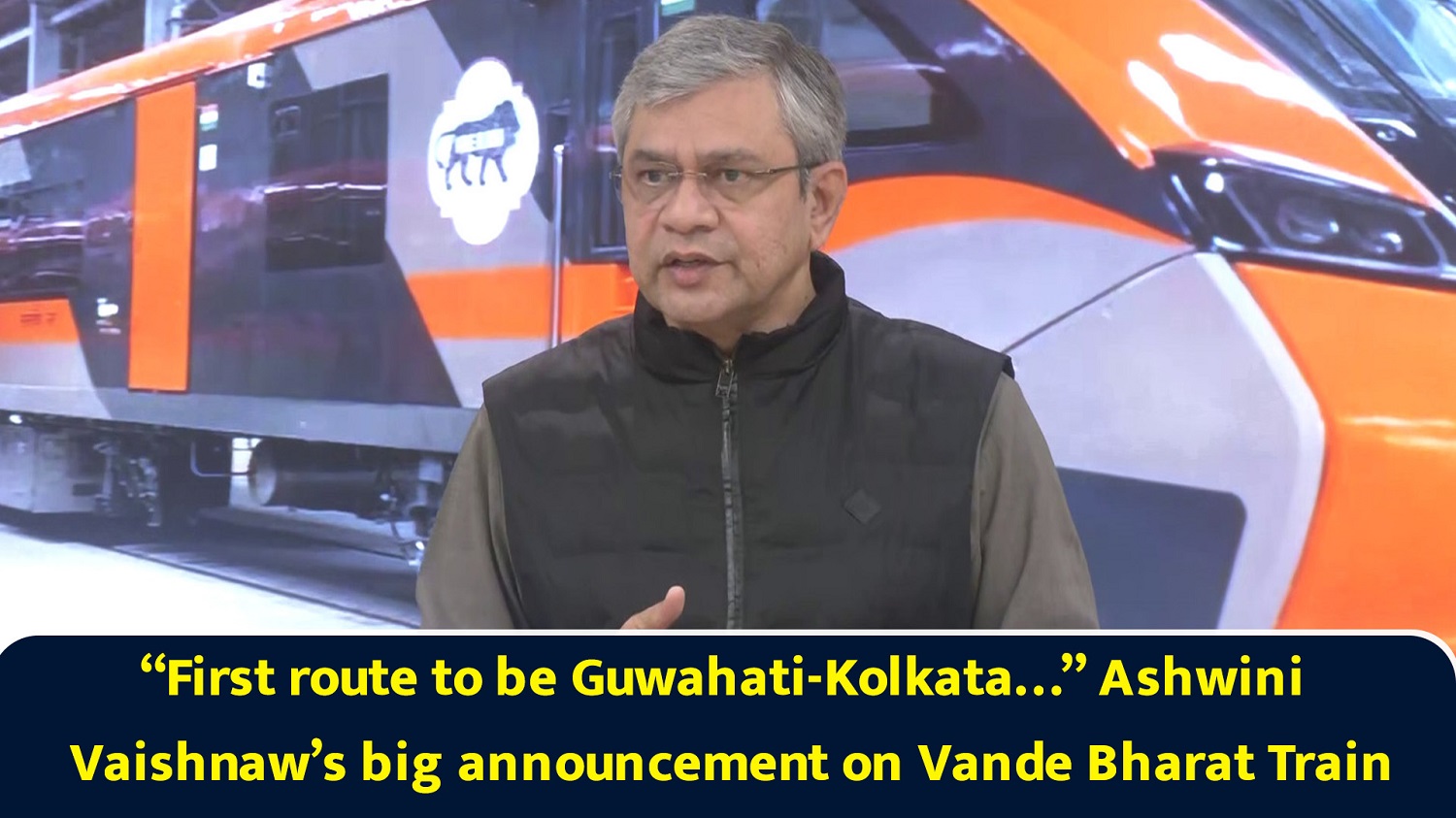

``First route to be Guwahati-Kolkata`` Ashwini Vaish...

Buy Ola Electric Mobility Ltd For Target Rs.43.30 by...

Buy Indusind Bank Ltd For Target Rs.990 by Jainam Sh...

Gold, Silver Start 2026 Higher After Best Gains in 4...

Buy Arvind Fashions Ltd for the Target Rs. 725 by Mo...

4 Week Focus : CSB Bank Ltd For Target Rs. 538 by Mo...

Technical Conviction Delivery Idea : Larsen and Toub...

Buy Turmeric APR @ 17600 SL 17300 TGT 17900-18100. N...

Nifty immediate support is at 26050 then 25950 zones...

Buy Natural Gas Jan @ 325 SL 318 TGT 333-340. MCX - ...

Top News

News Not Found

Tag News

News Not Found

More News

News Not Found