No Record Found

Latest News

Buy HCL Technologies Ltd for the Target Rs. 2,200 by...

High Yields: A Potential Fault Line for Debt Dynamic...

Buy TCS Ltd for the Target Rs. 4,400 by Motilal Oswa...

WhiteOak Capital Mutual Fund launches `WhiteOak Capi...

Pre- Budget Expectation Quote on Travel and Fintech ...

Buy Lemon Tree Hotels Ltd for the Target Rs. 200 by ...

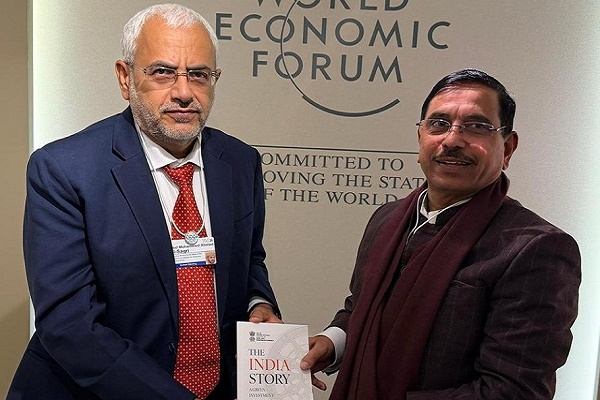

Pralhad Joshi makes strong pitch for investments in ...

Global PC shipments up 9.3 pc in Oct-Dec in AI era

India`s transition to low-carbon green steel a gradu...

Newgen Software clocks 29.4 pc drop in Q3 profit, sh...

Top News

News Not Found

Tag News

News Not Found

More News

News Not Found