No Record Found

Latest News

Expectations on Union Budget 2026?27 by Dilip Modi, ...

Expectations on Union Budget 2026?27 by Mat?as Gainz...

Bank of India, Mumbai North Zone Hosts ``Pravasi Sam...

Kotak Mutual Fund Launches Kotak Nifty200 Value 30 I...

Kishan Reddy urges CM Revanth Reddy to expedite take...

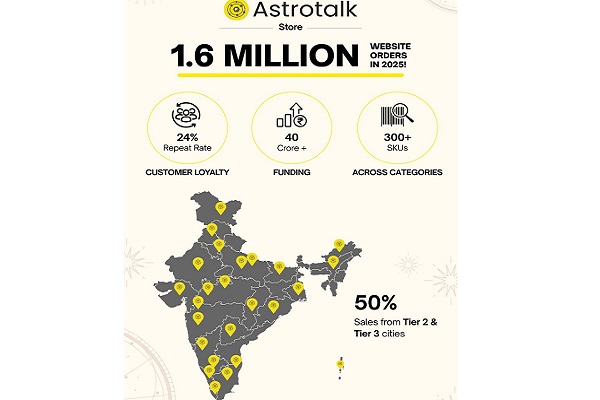

Astrotalk Store - From a Rs 30 lakh investment to Rs...

Government ensures record fertilisers for farmers at...

China`s overstated official GDP figures raise doubts...

KRM Ayurveda coming with IPO to raise Rs 77.49 crore

FIIs stood as net sellers in equities as per January...

Top News

News Not Found

Tag News

News Not Found

More News

News Not Found