No Record Found

Latest News

India`s capex contracts 23.4 pc in Q3 due to some ad...

PM Narendra Modi hails rice revolution & Kerala Kumb...

India committed to making global clean energy transi...

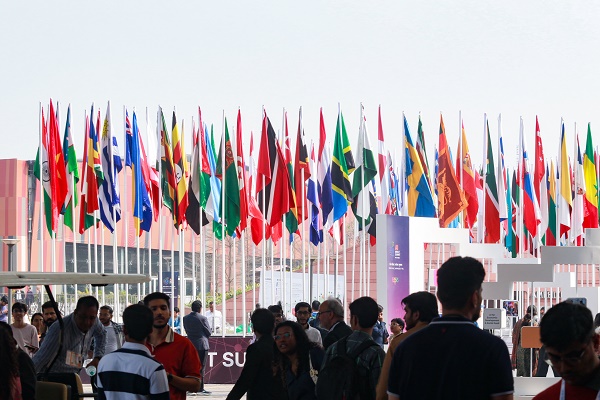

India Impact Summit shows how AI will be governed, d...

Foreign investors offload $6.2 billion on main Seoul...

DIIs continue to provide strong support to markets d...

US tariff refund could be a `mess` but a psychologic...

IT Sector Update : Palantir, Anthropic, and its impa...

Buy ICICI Bank Ltd for the Target Rs.1,750 by Motila...

Buy TeamLease Ltd for the Target Rs.1,850 by Motilal...

Top News

News Not Found

Tag News

News Not Found

More News

News Not Found