No Record Found

Latest News

The Rise of Oversized T-Shirts for Women: Comfort Me...

Zomato appoints Aditya Mangla as CEO of food orderin...

CII President Rajiv Memani confident of India`s posi...

Goa CM Pramod Sawant performs ?Maha Abhishek? of Lor...

South Korea: Record 1 million shop owners close busi...

LG Electronics to work with Saudi Arabia to develop ...

Adani Enterprises announces Rs 1,000 crore NCDs offe...

FTAs will never come at the cost of national interes...

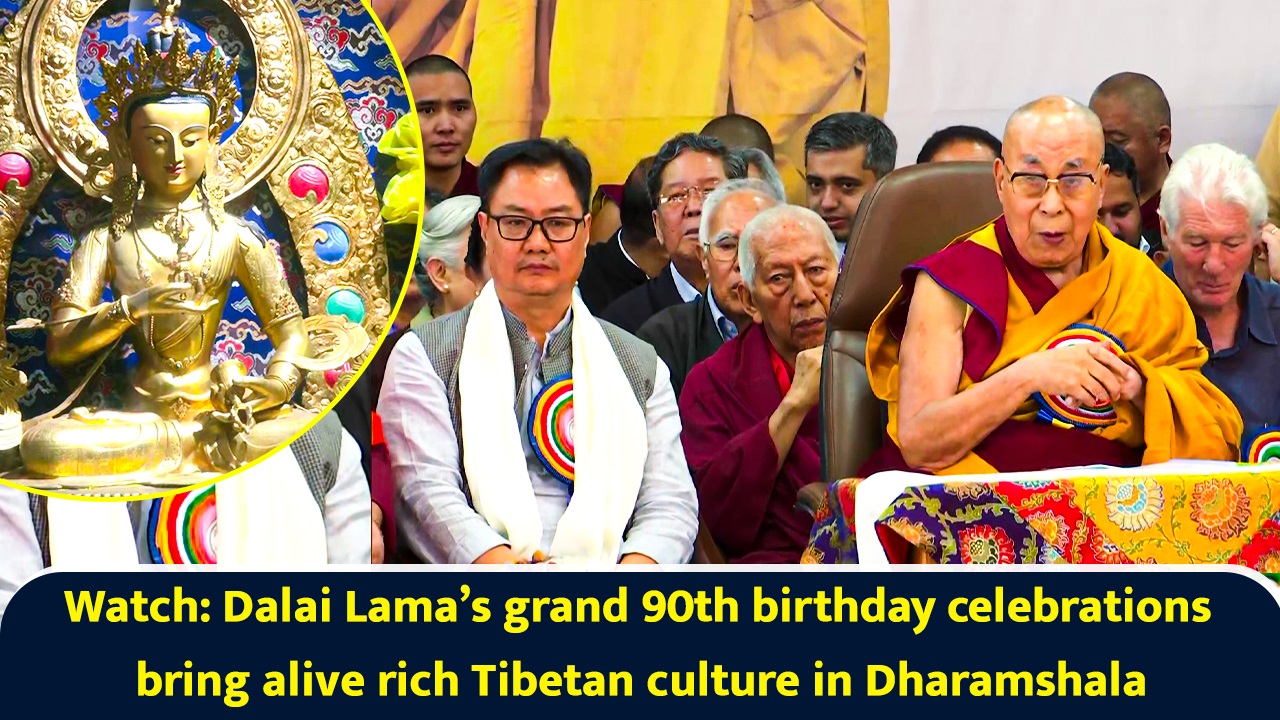

Watch: Dalai Lama`s grand 90th birthday celebrations...

Nifty & Bank Nifty Weekly Outlook 06 July 2025 by Ch...

Top News

News Not Found

Tag News

News Not Found

More News

News Not Found