No Record Found

Latest News

Budget Expectation Quote on Healthcare Sector by Dr....

Indian equities enter 2026 on firmer footing as earn...

Former UTI Pension Fund CEO Balram Bhagat joins The ...

Global publishing leader highlights India`s literary...

PM Narendra Modi to inaugurate 28th Commonwealth Spe...

Budget Expectation Quote 2026 by Satishwar B., MD & ...

WPL: Amanjot feels blessed to witness `the Harmanpre...

Quote on Budget Expectation by Saurav Ghosh, Co-foun...

Extra 5 minutes of sleep, 2 minutes of brisk walking...

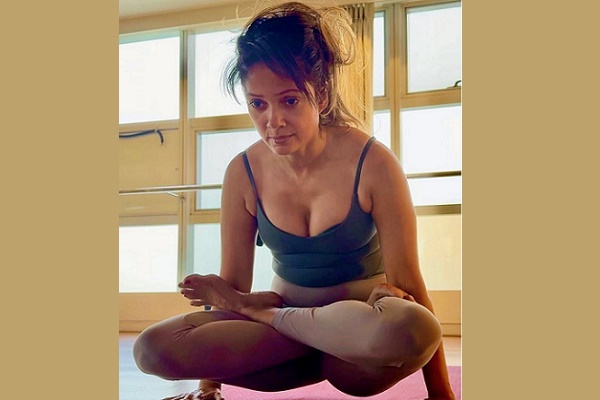

Vidya Malvade performs difficult `yoga aasans` like ...

Top News

News Not Found

Tag News

News Not Found

More News

News Not Found