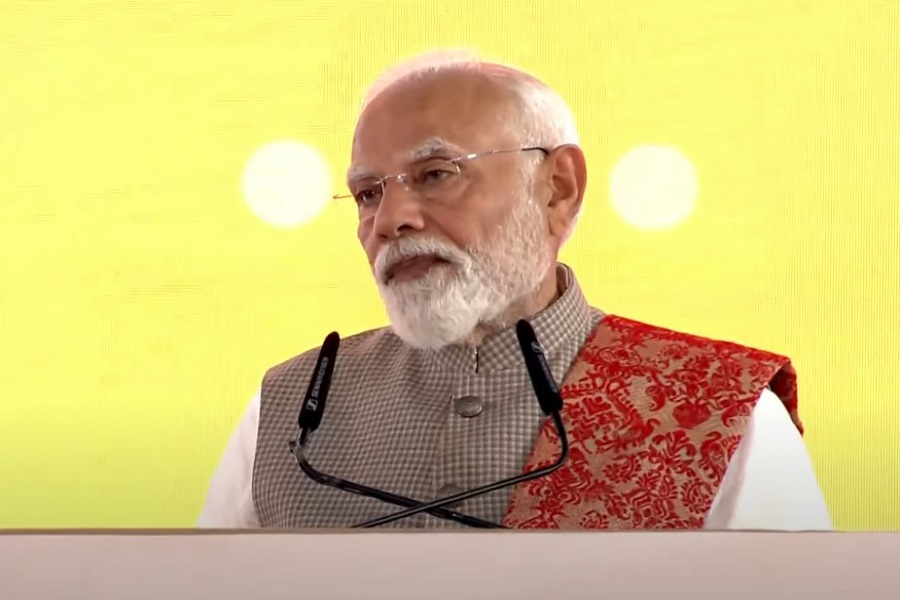

Weekly Note Oct 25 by Mr. Ajit Mishra - SVP, Research, Religare Broking Ltd

Markets Wrap Up Diwali-Shortened Week on a Positive Note; Focus Turns to Earnings and Fed Policy Decision

Market Summary

Markets extended their winning streak for the fourth consecutive week, closing the Diwali-shortened week on a modestly positive note. The sentiment remained upbeat during the initial sessions, but profit-booking toward the end trimmed some gains. Consequently, the Nifty rose 0.33% to settle at 25,795.15, while the Sensex advanced 0.31% to close at 84,211.88.

Key Market Drivers

Better-than-expected Q2 earnings from major companies lifted overall sentiment, further supported by renewed optimism over potential India–U.S. trade collaborations and easing tariff tensions between the U.S. and China. Additionally, sustained foreign investor interest—totaling over ?50,000 crore in announced investments in India’s financial and banking sectors—contributed to the positive tone. However, macroeconomic indicators showed signs of moderation, as the output of eight core industries slowed to 3% in September 2025, compared with 6.5% in August. The HSBC Flash India Composite Output Index also eased to a five-month low of 59.9 in October, hinting at a mild cooling in private-sector momentum.

Sectoral Snapshot

Sectoral trends reflected a mix of optimism and caution. IT stocks led the gains, advancing over 3% amid renewed buying interest, followed by the Metal index, which climbed 1.5% on improving global cues and a softer dollar. In contrast, Auto and FMCG stocks faced mild profit-taking, each slipping about 0.4%. In the broader market, midcap and smallcap segments posted moderate gains, indicating selective accumulation in fundamentally strong counters.

Key Events to Watch

The upcoming week is expected to remain eventful, driven by a series of key earnings announcements and macroeconomic data releases. The ongoing Q2FY26 results season will continue to shape market direction, with several major companies scheduled to release their financials. Investors will first react to Kotak Mahindra Bank’s results, followed by updates from IOC, TVS Motor Company, Larsen & Toubro, Hindustan Petroleum, ITC, Cipla, Dabur India, Maruti Suzuki India, Bharat Electronics, and ACC. These results will provide a clearer picture of sectoral trends and corporate profitability ahead of the festive quarter.

On the macroeconomic front, India’s Industrial Production data for September, due on October 28, will be closely tracked for signs of industrial recovery following a 4% growth in August. Globally, the focus will shift to the U.S. Federal Reserve’s policy decision on October 29, which could influence global liquidity trends and risk sentiment. Additionally, market participants will monitor developments surrounding the scheduled U.S.–China presidential meeting, which could further ease trade tensions and impact global markets.

Technical Outlook

* Nifty (25,795.15): After four consecutive weeks of gains, Nifty is likely to enter a consolidation phase. Traders should maintain a “buy-on-dips” strategy, with immediate support around 25,600 and then 25,400 levels. On the upside, resistance is seen near 26,000, followed by a potential move toward a new record high around 26,300.

* Bank Nifty (57,699.60): The banking index is also indicating consolidation after a strong rally, which would be a healthy pause. Investors should use declines to accumulate quality names from both private and PSU banks. Support is placed around 56,700 and 55,900, while resistance lies near 58,500 and then 60,000.

* Broader Indices: While broader markets show signs of stability, participation remains limited to select stocks. Traders should exercise caution in the midcap and smallcap segments and focus on fundamentally sound counters.

Strategy Ahead

Markets are likely to begin the final week of October with a cautiously optimistic tone. Strong corporate earnings, steady foreign inflows, and improving global sentiment offer a constructive backdrop, though geopolitical uncertainties, scheduled monthly expiry and the upcoming U.S. Fed policy decision could trigger short-term volatility.

Traders are advised to maintain a buy-on-dips approach, focusing on sectors that exhibit consistent accumulation such as auto, banking, and metals, while remaining selective in others. Export-oriented stocks may witness short-term swings in line with global developments. Within the broader market, preference should be given to large-cap and high-quality midcap names with robust fundamentals, while being mindful of potential profit-taking near record highs.

Above views are of the author and not of the website kindly read disclaimer

More News

Technical Forecast : Nifty ends flats by Vaishali Parekh, Vice President - Technical Researc...